The global well intervention market was valued at USD 9.30 billion in 2023 and is projected to reach USD 12.01 billion by 2030, expanding at a CAGR of 3.9% from 2024 to 2030. Market growth is largely driven by the increasing global energy demand, ongoing oilfield development, and efforts to enhance productivity in mature and conventional fields across various regions.

The presence of vast untapped hydrocarbon reserves and the significant role of the oil and gas industry in national economies are expected to continue fueling market expansion. Additionally, the growing number of deepwater and ultra-deepwater exploration projects in areas such as the North Sea and the Gulf of Mexico is anticipated to bolster the demand for well intervention services.

Mature oil and gas fields are a key growth driver for the market. These fields often experience a decline in production capacity, making extraction economically inefficient without technical upgrades. Such fields are frequently equipped with outdated infrastructure, limiting recovery. Well intervention techniques help resolve these challenges by enabling cost-effective resource recovery and extending the operational life of wells.

Technological advancements are further transforming the sector. Enhanced automation and digitalization have led to improved intervention outcomes. According to a July 2023 report by Rystad Energy, approximately USD 58.0 billion was expected to be invested globally in well intervention activities in 2023—marking a nearly 20% increase compared to the previous year. The report also forecasted around 260,000 well interventions globally by 2027, reflecting robust future demand.

Order a free sample PDF of the Well Intervention Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America held the largest revenue share of 39.5% in 2023. Growth in this region is supported by increased crude oil and natural gas production, expansion of shale drilling, and new offshore projects, especially in the Gulf of Mexico. The region's focus on exploiting untapped reserves and technological advancements further supports market growth.

- By service, the stimulation segment led the market with a 21.1% share in 2023. This is due to the rise in well stimulation activities aimed at improving production efficiency. For instance, in July 2023, Trendsetter Engineering, Inc. conducted deepwater stimulation on wells in the Gulf of Mexico, significantly enhancing productivity and showcasing the demand for acid treatments and stimulation campaigns.

- By intervention type, the light intervention segment dominated with a 57.7% market share in 2023. This type of intervention is preferred due to its ability to resolve issues without halting production. In May 2023, TechnipFMC plc signed a two-year contract with Equinor to provide riderless light well intervention (RLWI) services, exemplifying the segment’s growing adoption.

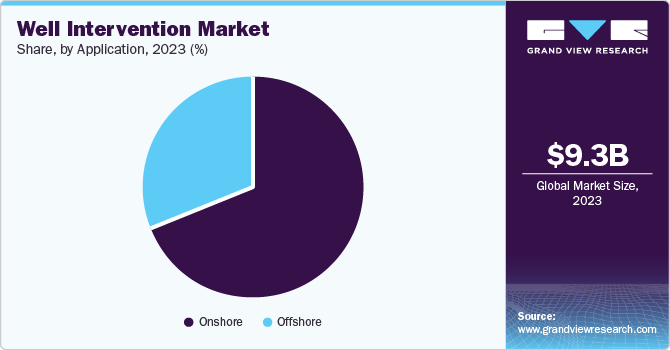

- By application, the onshore segment accounted for the largest share of 68.8% in 2023. Growth is being driven by the increased development of new onshore oilfields and expanding drilling activities. For example, in November 2023, Sinopec completed the drilling of a 9,432-meter ultra-deep gas and oil well in China, signaling growing activity in the region.

Market Size & Forecast

- 2023 Market Size: USD 9.30 Billion

- 2030 Projected Market Size: USD 12.01 Billion

- CAGR (2024-2030): 3.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The well intervention industry is characterized by strong competition among major players such as SLB, Baker Hughes Company, Halliburton Company, Weatherford, NOV, Helix Energy, Expro Group, Welltec A/S, TechnipFMC plc, and others. These companies are actively pursuing strategic collaborations, mergers, and acquisitions to expand their market reach and technological capabilities.

- SLB (formerly Schlumberger) offers a broad portfolio of products and services across oilfield operations, including well intervention. It emphasizes innovation in decarbonization, digital transformation, and scaling new energy systems.

- Baker Hughes Company operates through two primary segments: Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology, with a focus on intervention services, production solutions, and completions under OFSE.

Key Players

- SLB

- Baker Hughes Company

- HALLIBURTON COMPANY

- Weatherford

- NOV.

- Helix Energy

- Oceaneering International, Inc.

- Expro Group

- Hunting PLC

- Archer (Deepwell AS)

- Welltec A/S

- TechnipFMC plc

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global well intervention market is poised for steady growth through 2030, driven by rising global energy demands, the need for enhanced oil recovery in aging fields, and technological advancements in intervention methods. Light interventions and stimulation services are gaining momentum due to their cost-effectiveness and ability to optimize production with minimal disruption.

North America remains the dominant regional market due to extensive offshore activity and shale development, while Asia Pacific emerges as the fastest-growing region, led by ongoing infrastructure investments and deepwell drilling operations.

As industry players continue to invest in digital innovation, automation, and sustainable extraction technologies, the well intervention market will play a critical role in optimizing existing oil and gas resources without the need for extensive new drilling.

No comments:

Post a Comment