The global short-wave infrared (SWIR) cameras and sensors market was valued at USD 328.4 million in 2024 and is projected to reach USD 620.2 million by 2030, expanding at a CAGR of 11.3% from 2025 to 2030. This growth is primarily fueled by rising demand for high-precision imaging technologies across a range of industries including defense, semiconductors, food inspection, and industrial automation.

The increasing use of SWIR technology in quality control, material sorting, and surveillance is significantly contributing to the market’s expansion. Technological advancements such as reduced power consumption, miniaturization, and enhanced sensitivity have made SWIR sensors more accessible and practical for a broader array of industrial applications.

SWIR cameras and sensors—particularly those based on focal plane array (FPA) technology—are becoming indispensable in numerous imaging use cases. Operating within the 0.9 to 1.7-micron wavelength range, SWIR imaging can detect hidden features, material variations, and moisture content—capabilities that outperform conventional visible and thermal imaging systems. These features make SWIR FPAs valuable across fields such as industrial inspection, scientific research, defense, and surveillance. Their functionality in low-light and obscured environments further extends their usability.

The market is witnessing strong adoption across both commercial and military sectors. Historically, defense applications have led the way due to SWIR’s effectiveness in visualizing objects through fog, smoke, and camouflage. However, advancements in InGaAs (Indium Gallium Arsenide) technology, cost reductions, and sensor miniaturization are rapidly expanding SWIR use cases into agriculture, machine vision, medical diagnostics, and semiconductor inspection. As automation and accuracy become increasingly vital in industrial imaging, SWIR systems are playing a growing role in non-destructive testing and precision quality control.

Order a free sample PDF of the Short-Wave Infrared Cameras & Sensors Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America dominated the global SWIR cameras and sensors market in 2024, accounting for a 38.4% revenue share. The region’s growth is driven by rapid technological advancements and rising demand in sectors such as defense, aerospace, and industrial automation. In particular, military and defense applications are major contributors, where SWIR is essential for surveillance, reconnaissance, and targeting in low-visibility environments. SWIR cameras provide critical imaging capabilities in darkness and through obscurants, offering a strategic edge.

- By technology, the cooled SWIR cameras and sensors segment captured the largest revenue share of 55.1% in 2024, due to their superior performance in low-light and long-range imaging. Their high sensitivity, excellent signal-to-noise ratio, and ability to operate effectively in complex conditions make them ideal for defense, aerospace, and semiconductor inspection applications.

- By product, the SWIR FPAs segment is expected to witness substantial growth during the forecast period. FPAs based on InGaAs, HgCdTe, and Quantum Dot technologies are gaining momentum due to their exceptional imaging quality in the SWIR spectrum. In particular, InGaAs FPAs are seeing widespread adoption in industrial, defense, and scientific applications.

- By application, the defense and military segment accounted for the largest share in 2024. SWIR systems are increasingly integrated with advanced technologies to enhance intelligence gathering, operational efficiency, and autonomy. These systems support real-time monitoring, target tracking, and accurate distance measurements, improving overall mission effectiveness.

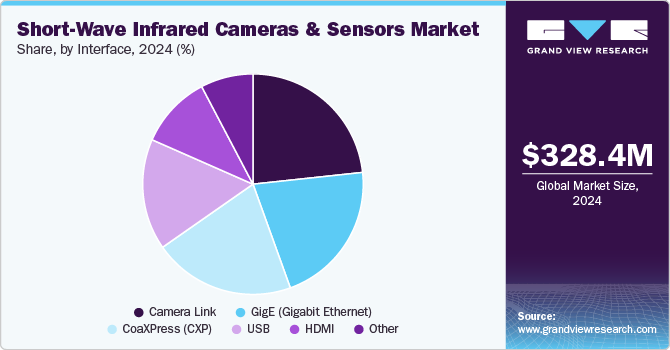

- By interface, the Camera Link segment experienced notable growth in 2024. The integration of Camera Link interfaces with SWIR sensors has enabled high-speed, automated inspections in industries such as semiconductor manufacturing, electronics, and food processing. This technology enhances inspection accuracy and consistency, allowing for faster production cycles and better quality control.

Market Size & Forecast

- 2024 Market Size: USD 328.4 Million

- 2030 Projected Market Size: USD 620.2 Million

- CAGR (2025-2030): 11.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading companies in the SWIR cameras and sensors market are focusing on product innovation, strategic collaborations, expansions, and mergers & acquisitions to enhance their global market presence.

- Teledyne FLIR is a prominent developer and supplier of SWIR technologies. The company offers a comprehensive portfolio spanning thermal imaging, visible-light imaging, diagnostics, and advanced threat detection. Its solutions support a wide range of applications in government, defense, commercial, and industrial sectors. Teledyne FLIR’s innovations improve safety, operational efficiency, and decision-making for professionals and military personnel alike.

- Hamamatsu Photonics is a global leader in optical sensor technologies. The company manufactures photodiodes, image sensors, photomultiplier tubes, and semiconductor lasers, along with specialized systems for medical, semiconductor, and life science industries. Its ongoing R&D in light-based technologies ensures continued innovation and sustainability through the company’s Global Strategic Challenge Center.

Emerging participants such as Xenics, New Imaging Technologies (NIT), and Princeton Infrared Technologies are also playing key roles by introducing cost-effective, compact, and high-performance SWIR solutions for niche and emerging applications.

Key Players

- Teledyne Technologies Incorporated.

- Hamamatsu Photonics

- Xenics (Exosens)

- Allied Vision Technologies

- Sensors Unlimited (Collins Aerospace)

- New Imaging Technologies (NIT)

- Princeton Infrared Technologies Inc.

- Raptor Photonics

- TriEye

- Chunghwa Leading Photonics Tech (CLPT)

- Active Silicon

- BitFlow, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global short-wave infrared (SWIR) cameras and sensors market is poised for steady and robust growth through 2030, underpinned by rising demand for high-resolution, non-invasive imaging solutions across multiple industries. While defense and military applications continue to be the dominant driver, commercial use cases in sectors such as semiconductors, agriculture, food inspection, and medical diagnostics are expanding rapidly.

Advancements in InGaAs technology, sensor miniaturization, and interface integration are making SWIR systems more accessible, cost-effective, and capable of meeting the complex imaging needs of modern industries. With North America leading current adoption and Asia Pacific emerging as the fastest-growing region, companies that continue to innovate and adapt to evolving application demands will be best positioned to capitalize on this market’s growth potential.

No comments:

Post a Comment