The global selective laser sintering (SLS) equipment market was valued at USD 572.6 million in 2023 and is expected to reach USD 2.5 billion by 2030, growing at a CAGR of 23.7% from 2024 to 2030. This growth is driven by the increasing demand for customized and personalized products across various industries. As consumers increasingly seek products tailored to their unique needs and preferences, manufacturers are turning to SLS technology to facilitate the on-demand production of highly intricate and bespoke components, offering both differentiation in competitive markets and customer satisfaction.

Technological advancements are playing a crucial role in driving the demand for SLS equipment. With ongoing improvements in precision, process refinement, and material variety, SLS technology continues to evolve. These advancements not only boost the performance and versatility of SLS equipment but also contribute to its cost-effectiveness, making it an attractive option for a wide range of applications.

Moreover, the growing focus on cost efficiency is pushing companies to explore alternative manufacturing methods like SLS. Although the initial investment in SLS equipment can be high, the technology offers long-term cost savings by reducing material waste, lowering tooling costs, and enhancing overall production efficiency. This efficiency, coupled with the increasing emphasis on environmentally friendly manufacturing, makes SLS a more sustainable solution compared to traditional methods, which generate more waste and use fewer recyclable materials.

Order a free sample PDF of the Selective Laser Sintering Equipment Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America dominated the market in 2023, accounting for 36.3% of the revenue. The region boasts a highly developed and advanced manufacturing ecosystem, particularly in industries such as aerospace, automotive, healthcare, and consumer goods. The growing demand for innovative manufacturing technologies, including SLS, is driven by the need for rapid prototyping, customization, and complex component production, which aligns well with SLS capabilities.

- The metal segment led by material type, holding the largest revenue share of 45.7% in 2023. The use of metal materials in SLS equipment allows for a broad range of applications across various industries, such as aerospace, automotive, healthcare, and industrial manufacturing. Metal parts produced with SLS technology meet stringent requirements for strength, durability, and performance, making them suitable for end-use applications in demanding environments.

- The gas laser segment dominated by laser type, holding the largest share in 2023. Gas lasers are versatile in material processing, enabling the sintering of a wide variety of materials, including metals, polymers, ceramics, and composites. This versatility allows SLS equipment with gas lasers to cater to diverse industries, broadening its market scope.

- The industrial printer segment was the leading technology segment in 2023. Industrial SLS printers typically feature large build volumes, which allows for the production of larger and more complex parts in a single build. This scalability enables manufacturers to improve production efficiency and accommodate a wide variety of part sizes and geometries, making industrial SLS printers suitable for a diverse range of applications.

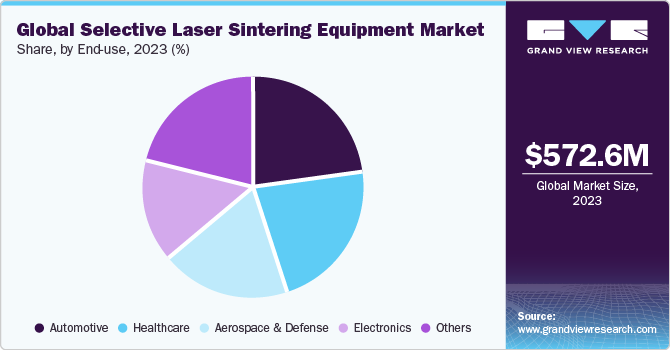

- The automotive segment dominated the end-use application in 2023, holding 23.1% of the market share. The automotive industry’s growing focus on lightweight vehicles to enhance fuel efficiency and reduce emissions is driving the adoption of SLS technology. Advanced materials, like carbon fiber-reinforced polymers and metal alloys, enable the production of lightweight yet durable components, reducing overall vehicle weight and improving fuel efficiency.

Market Size & Forecast

- 2023 Market Size: USD 572.6 Million

- 2030 Projected Market Size: USD 2.5 Billion

- CAGR (2024-2030): 23.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Notable players in the SLS equipment market include 3D Systems Inc., EOS GmbH, and Farsoon Technologies.

- 3D Systems Inc. is a leading player in the 3D printing space, offering a comprehensive range of solutions, including SLS equipment. Known for their reliability and versatility, 3D Systems' SLS machines serve a wide variety of industries, such as aerospace, automotive, healthcare, and consumer goods.

- EOS GmbH specializes in the development and production of high-quality 3D printers and materials for industrial applications. Its portfolio includes advanced SLS and DMLS systems, which are capable of producing complex geometries and functional parts with high precision.

Emerging players such as Prodways Group, Formlabs Inc., and Ricoh Company Ltd. are also making strides in the SLS market.

- Prodways Group is known for its expertise in additive manufacturing, including prototyping, tooling, and end-use part production. The company focuses on delivering customized solutions tailored to its customers' needs.

- Formlabs provides a diverse range of 3D printers and materials optimized for various applications. Its Form series of printers are widely used for engineering prototypes, dental models, and other precision applications.

Key Players

- 3D Systems Inc.

- EOS GmbH

- Farsoon Technologies

- Prodways Group

- Formlabs Inc.

- Ricoh Company Ltd

- Concept Laser GmbH (General Electric)

- Renishaw PLC

- Sinterit Sp. Zoo

- Sintratec AG

- Sharebot SRL

- Red Rock SLS

- Natural Robotics

- Z Rapid Tech

- Aerosint

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The selective laser sintering equipment market is on an impressive growth trajectory, fueled by the increasing demand for customized products, technological advancements, and the push toward cost-effective and sustainable manufacturing solutions. North America remains the dominant market, with significant adoption in industries like aerospace, automotive, and healthcare, while Asia Pacific is expected to be the fastest-growing region. As the capabilities of SLS technology continue to expand, and with its increasing applications across various industries, the market is poised for robust growth in the coming years. Manufacturers adopting SLS technology can expect long-term benefits in terms of cost efficiency, product customization, and sustainability, positioning the market for continued innovation and expansion.

No comments:

Post a Comment