The global telecom power systems market was valued at USD 3.30 billion in 2022 and is projected to grow to USD 7.69 billion by 2030, expanding at a compound annual growth rate (CAGR) of 12.2% from 2023 to 2030. These systems are primarily designed to support fixed-line applications and wireless broadband access.

Key drivers for market growth include the increasing deployment of telecom towers in remote areas and the rise of cell power systems for LTE networks. Telecom power systems are essential for maintaining network reliability, controlling and monitoring power distribution, and ensuring uninterrupted service during disruptions or grid power fluctuations. The market has evolved due to the adoption of digital technologies and their integration into telecom infrastructure.

The surge in cellular data traffic is pushing the expansion of mobile networks, including in rural and remote regions. The widespread adoption of connected devices is also contributing to the demand for power systems for picocells and femtocells. As telecom networks expand to improve connectivity, the market continues to benefit globally. Telecom operators are also integrating advanced wireless technologies such as Wi-Fi 6 and 5G, providing greater data capacity, lower latency, and more efficient service. An example of such innovation includes the collaboration between Robert Bosch GmbH and Nokia, which launched a private 5G network at Bosch's Industry 4.0 plant in Stuttgart, Germany, in November 2020.

Order a free sample PDF of the Telecom Power Systems Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific held the largest market share of 35.7% in 2022 and is expected to experience the fastest growth during the forecast period. This growth is largely driven by the rapid digital transformation in several developing countries in the region, creating opportunities for telecom operators to build sustainable ecosystems.

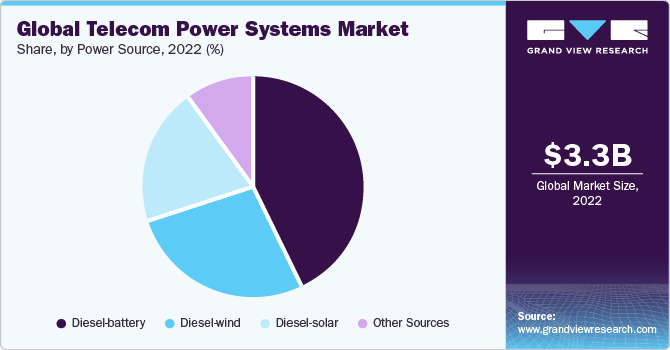

- Diesel-battery systems dominated the power source segment, accounting for 43.1% of the market share in 2022. These systems are attractive due to their lower capital investment requirements and their ability to reduce carbon emissions. As a result, they are favored by telecom operators in developing countries such as India, Brazil, and Mexico. The diesel-wind segment is also poised for significant growth due to the installation of new plants and long-term contracts, as well as priority access to grids.

- In terms of product type, the DC power systems segment held the largest share of 62.7% in 2022 and is expected to grow at the fastest rate. DC power systems convert AC to DC and provide stable power to charge batteries, offering precise control over power distribution and voltage levels, and ensuring system reliability.

- The on-grid segment dominated the grid-type category with 41.7% market share in 2022. On-grid systems are connected to the utility grid, allowing excess power to be transmitted back to the grid. These systems are cost-effective and are expected to pay for themselves in 3 to 8 years due to the reduction in utility bills.

Market Size & Forecast

- 2022 Market Size: USD 3.30 Billion

- 2030 Projected Market Size: USD 7.69 Billion

- CAGR (2023-2030): 12.2%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

Key Companies & Market Share Insights

The telecom power systems market includes both large and medium-sized companies. To stay competitive, providers are focused on developing advanced, energy-efficient systems that offer product reliability, scalability, and optimized designs. For example, in October 2020, Cummins Inc. introduced two new digital master controls—DMC2000 and DMC6000—to enhance the performance and cost-effectiveness of their power systems.

Prominent players in the industry are also forming strategic partnerships to enhance their product portfolios. For instance, in March 2020, Corning Incorporated partnered with US Conec Ltd. to introduce MDC connector solutions, which are expected to improve carrier distribution networks, hyper-scale data centers, and other high-density patching applications.

Key Players

- Alpha Technologies Services, Inc.

- Ascot

- Eaton

- General Electric

- Huawei Technologies Co., Ltd.

- Schneider Electric

- ZTE Corporation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global telecom power systems market is poised for substantial growth driven by the increasing demand for reliable and efficient telecom infrastructure. The expansion of cellular networks, particularly in rural and remote areas, coupled with the rise of next-gen technologies like 5G and Wi-Fi 6, presents significant opportunities. Key regions such as Asia Pacific are expected to lead in market share, while diesel-battery solutions and on-grid systems are likely to dominate in terms of power sources and grid types. The market's growth will also be propelled by innovation in system designs and strategic collaborations among leading telecom players.

No comments:

Post a Comment