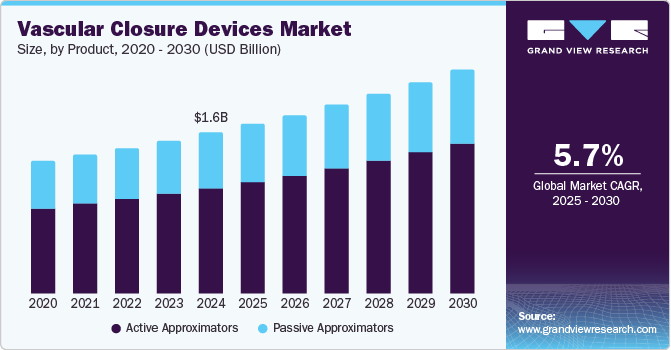

The global vascular closure devices (VCDs) market was valued at USD 1.56 billion in 2024 and is projected to reach USD 2.17 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. This market growth is primarily driven by the rising prevalence of cardiovascular diseases (CVDs), which has led to an increase in vascular procedures, directly boosting the demand for vascular closure devices.

Advancements in VCD technologies have significantly enhanced procedural safety and efficiency, contributing to their wider adoption. Additionally, the aging population, which is more susceptible to vascular disorders, is expected to further fuel market demand. Supportive reimbursement policies for interventional radiology, particularly in developed markets, have also played a pivotal role in driving adoption.

For example, in the United States, Medicare’s comprehensive coverage of outpatient vascular procedures has encouraged healthcare providers to increase the use of vascular closure devices. Simultaneously, rising healthcare expenditures in developing nations are improving access to advanced medical technologies, including VCDs.

Order a free sample PDF of the Vascular Closure Devices Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America held the largest market share at 44.4% in 2024, supported by a high burden of cardiovascular diseases and a robust healthcare infrastructure. The presence of advanced medical technologies and a high rate of minimally invasive procedures have further accelerated market expansion in this region.

- By Product: The active approximators segment accounted for 65.7% of total market revenue in 2024. This segment's dominance is attributed to the growing demand for minimally invasive techniques and the increasing frequency of catheterization procedures. Meanwhile, passive approximators are commonly used in specific clinical cases where active devices may not be appropriate.

- By Application: Peripheral vascular interventions are projected to be the second fastest-growing segment through 2030, driven by the increasing incidence of conditions such as peripheral artery disease (PAD). These interventions aim to reduce recovery times and hospital stays, contributing to greater demand for VCDs in this category.

- By End Use: The hospitals and clinics segment led the market in terms of revenue in 2024. These facilities handle a high volume of vascular procedures, such as cardiac catheterizations and angioplasties. The preference for VCDs in hospitals is supported by their ability to shorten hemostasis time, reduce procedural complications, and promote early ambulation, all of which improve clinical outcomes and operational efficiency.

Market Size & Forecast

- 2024 Market Size: USD 1.56 Billion

- 2030 Projected Market Size: USD 2.17 Billion

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Major players in the global vascular closure devices market include Abbott, Cardinal Health, Medtronic, Merit Medical, and Teleflex Incorporated, among others.

- Abbott is a leading provider of VCDs, known for its innovation in cardiovascular technology and strong global presence.

- Cardinal Health and Medtronic offer a broad range of interventional solutions, leveraging their extensive R&D capabilities and distribution networks.

- Merit Medical and Teleflex continue to strengthen their market position through product development and strategic acquisitions.

Key Players

- Abbott

- Cardinal Health

- Medtronic

- Merit Medical

- Teleflex Incorporated

- Terumo Medical Corporation

- Meril Life

- Haemonetics

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The vascular closure devices market is set for steady growth through 2030, driven by the increasing prevalence of cardiovascular conditions, an aging global population, and rising demand for minimally invasive vascular procedures. North America is expected to retain its leading position due to advanced healthcare infrastructure and favorable reimbursement frameworks. Continued technological advancements, coupled with expanded healthcare access in emerging economies, are expected to support sustained market expansion. Companies that invest in innovation, clinical efficacy, and accessibility will be well-positioned to capitalize on the growing demand for vascular closure solutions.

No comments:

Post a Comment