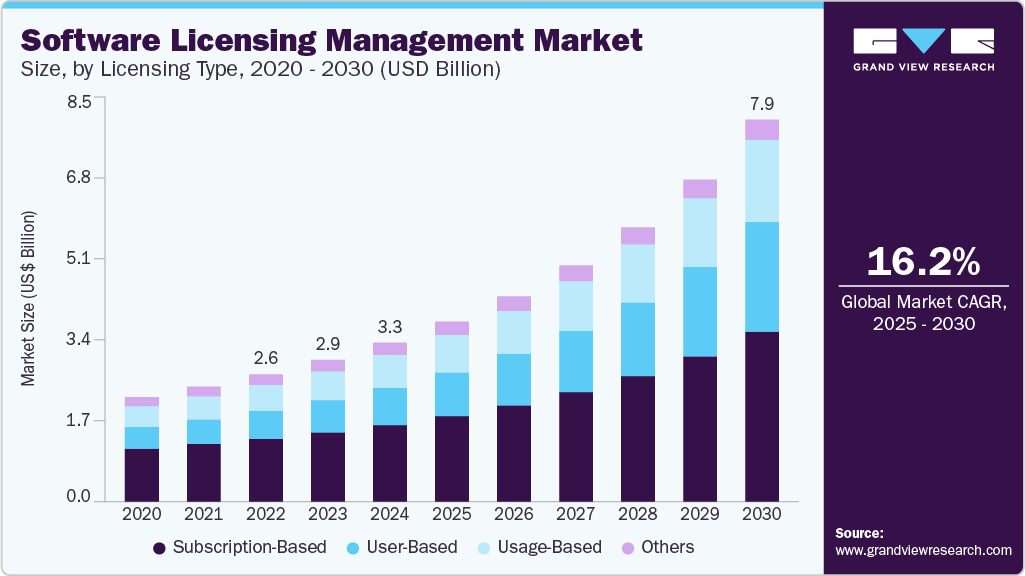

The global software licensing management (SLM) market was valued at USD 3,296.4 million in 2024 and is projected to reach USD 7,913.5 million by 2030, growing at a CAGR of 16.2% from 2025 to 2030. This significant growth is driven by digital transformation, the increasing adoption of cloud technologies, and growing regulatory demands.

As businesses continue to shift towards cloud-based infrastructures and Software as a Service (SaaS) models, there is a rising demand for scalable and flexible SLM solutions that can manage dynamic license environments. This trend is leading vendors to develop cloud-native software licensing management platforms that offer real-time tracking and license optimization. The integration of artificial intelligence (AI) and automation within these systems further boosts efficiency by enabling predictive analytics, automating compliance checks, and identifying underutilized software. These features allow organizations to reduce costs and make data-driven decisions regarding their software investments.

Effective SLM involves maintaining visibility over software assets, monitoring usage, managing vendor relationships, ensuring timely license renewals, and automating lifecycle management. These practices help organizations reduce waste, eliminate redundant licenses, and streamline software provisioning and deprovisioning. The move toward subscription-based models, highlighted by platforms like Zluri's SaaS management platform, emphasizes the importance of robust SLM in managing recurring costs and adapting to changing software usage patterns. Businesses can use these tools to gain real-time insights, enforce licensing policies, and integrate with enterprise systems to ensure efficient license utilization and support strategic decision-making.

A major example of innovation in this space is Flexera's new Cloud License Management solution, launched in April 2025. This tool helps organizations optimize cloud software costs by up to 25%, providing unified visibility and actionable insights into cloud software spend, which is crucial for IT asset management (ITAM) and financial operations (FinOps) teams.

Order a free sample PDF of the Software Licensing Management Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America led the market in 2024, accounting for over 38.2% of the revenue. Key drivers in this region include stringent regulatory compliance requirements like SOX and HIPAA, which mandate transparency in software usage and auditing. The growth of cloud services and hybrid work environments has also increased the complexity of software ecosystems, making robust license management solutions essential. Furthermore, leading companies are implementing strategic initiatives to boost market growth.

- Subscription-based licensing dominated the market in 2024, accounting for over 48.2% of the global revenue. The ongoing transition to SaaS and cloud-based solutions has made subscription models highly popular due to their flexibility, predictable revenue streams, and enhanced customer satisfaction. Major companies, such as Adobe, Microsoft, and Netflix, have successfully adopted this model, reinforcing its widespread appeal.

- Cloud deployment held the largest revenue share in 2024. The shift to cloud-based deployments and subscription models is transforming the SLM market. By integrating AI and automation, these solutions enhance predictive analytics and optimize license management processes, which is especially beneficial for small and medium-sized enterprises (SMEs). The complexity of modern software ecosystems and stringent compliance requirements are further driving organizations to adopt advanced SLM systems.

- Large enterprises dominated the market by enterprise size in 2024. These organizations increasingly adopt SaaS models and require sophisticated license management tools to ensure compliance and optimize costs. The rise of unused software highlights the need for effective license tracking to avoid waste. AI and automation further improve predictive analytics and compliance checks, boosting market expansion.

- The BFSI (Banking, Financial Services, and Insurance) segment held the largest share by end-use sector in 2024. This growth is attributed to the sector's increasing regulatory compliance demands and the need to mitigate risks related to software audits and penalties. As BFSI organizations adopt cloud computing, SaaS solutions, and digital transformation, managing dynamic software environments has become a critical focus, especially in light of data security and privacy concerns.

Market Size & Forecast

- 2024 Market Size: USD 3,296.4 Million

- 2030 Projected Market Size: USD 7,913.5 Million

- CAGR (2025-2030): 16.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key players in the software licensing management market include Agilis International, Microsoft Corporation, Oracle Corporation, ServiceNow, Flexera Software, HP, Inc., and IBM Corporation, all of which are pursuing aggressive strategies to expand their customer bases and enhance their competitive positions. Some recent developments include:

- Flexera Software launched its new Cloud License Management solution in April 2025, which helps organizations optimize cloud software costs by up to 25%. This tool is built on Flexera's Technology Intelligence Platform and offers unified visibility and actionable insights into cloud software spend.

- IBM is a global leader in AI and hybrid cloud solutions, offering a comprehensive suite of software licensing management tools that help organizations modernize, automate, and secure their IT environments. IBM's commitment to responsible business and innovation in software solutions makes it a strong player in this market.

- Microsoft is a major player in the software licensing management market, offering robust solutions to optimize software usage and ensure compliance. Microsoft supports businesses through flexible licensing models and advanced management tools, helping them streamline operations and enhance security.

- Thales launched the CipherTrust Data Security Platform in November 2024, expanding its offerings with CipherTrust Transparent Encryption (CTE). This service enables high-performance, transparent encryption for complex environments, helping organizations meet compliance requirements and protect sensitive data.

Key Players

- Agilis International / Agilis Management, Inc.

- DXC Technology

- Flexera Software

- HP, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Reprise Software

- SafeNet, Inc. (now part of Thales)

- ServiceNow

- Snow Software

- Thales Group (including Gemalto)

- USU Software AG

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The software licensing management market is poised for significant growth, driven by the shift toward cloud computing, SaaS models, and the increasing complexity of software ecosystems. As organizations embrace digital transformation and face mounting regulatory pressures, the demand for scalable, efficient, and AI-enabled SLM solutions will continue to rise. North America remains the largest market, while Asia Pacific is expected to be the fastest-growing region. With ongoing innovations and strategic initiatives by key players, the market is set to expand significantly by 2030, offering substantial opportunities for both established companies and new entrants.

No comments:

Post a Comment