The global software defined radio (SDR) market was valued at USD 29,491.4 million in 2024 and is projected to grow to USD 47,753.9 million by 2030, registering a CAGR of 8.4% from 2025 to 2030. Market growth is being driven by increasing demand for flexible, multi-frequency, and interoperable communication systems across defense, telecommunications, and public safety sectors.

SDR technology’s ability to operate seamlessly across multiple frequencies and protocols continues to push adoption across industries. The rapid evolution of wireless communication technologies—including 5G, IoT, and satellite communications—is further fueling market expansion. SDRs support software-based modulation techniques, enabling compatibility with multiple communication standards, which makes them well-suited for diverse telecom applications. Additionally, the growing need for interoperability among modern and legacy communication networks is strengthening the adoption of SDRs, as these systems enhance operational efficiency and system integration.

Rising government investments in defense modernization are also contributing to market growth. Increased defense budgets are enabling the upgrade of military communication infrastructures to support greater resiliency, speed, and flexibility. As security threats evolve and technological complexity increases, integrating commercial technologies such as 5G and artificial intelligence into military communication platforms is expected to enhance data transmission capabilities and strengthen network reliability—further advancing the SDR market.

Order a free sample PDF of the Software Defined Radio Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America led the market in 2024 with 33.52% of global revenue, driven by substantial investments in defense communication upgrades and public safety networks. The region is focusing on resilient, secure systems capable of operating across multiple frequencies and leveraging cognitive radio technology. The expansion of 5G deployment is further supporting SDR demand due to its need for flexible communication platforms.

- By Type: The joint tactical radio system (JTRS) segment accounted for the largest revenue share of 33.12% in 2024, reflecting its essential role in military and defense communication. JTRS enables secure, interoperable communication across platforms, allowing real-time data exchange among allied forces. Rising geopolitical tensions and the increasing demand for adaptive, mission-critical communication systems are driving investment in JTRS technology.

- By Component: The hardware segment held the largest share—41.16% in 2024—as SDR performance depends heavily on high-quality components such as antennas, transceivers, and amplifiers. As adoption rises across telecom, defense, and public safety applications, upgrading existing infrastructure with SDR-compatible hardware has become essential, sustaining strong demand for this segment.

- By Frequency Band: The high-frequency (HF) segment led the market with 30.90% of total revenue in 2024. HF communication remains vital for long-distance transmission, especially in military, maritime, and aviation environments. HF signals travel long ranges by reflecting off the ionosphere, making HF SDR systems indispensable in remote or international settings where satellite connectivity is limited. Their reliability and adaptability are driving continued demand.

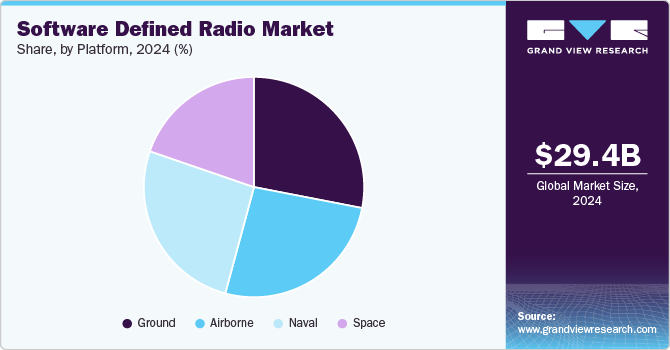

- By Platform: The ground platform segment accounted for 28.05% of revenue in 2024. Ground-based SDR systems offer flexibility and scalability required for applications such as base stations, command centers, and emergency response networks. Their adaptability to multi-frequency operations makes them crucial for defense and public safety communications.

- By End Use: Aerospace & defense remained the largest end-use segment in 2024, commanding 23.90% of revenue. SDRs are essential in defense operations due to their ability to support multiple frequencies, communication standards, and encryption protocols. Their adaptability enhances mission effectiveness and ensures secure, interoperable communications across military units and allied forces.

Market Size & Forecast

- 2024 Market Size: USD 29,491.4 Million

- 2030 Projected Market Size: USD 47,753.9 Million

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Major industry participants include RTX Corporation and Northrop Grumman Corporation.

- RTX Corporation: Formed through the merger of Raytheon Company and United Technologies Corporation, RTX is a major aerospace and defense firm known for advanced technology solutions. Its Collins Aerospace division is particularly recognized for developing SDR systems that enhance secure communication capabilities across multiple platforms.

- Northrop Grumman Corporation: Northrop Grumman is a leading aerospace and defense technology provider offering advanced SDR solutions designed for complex military operations. With strong R&D focus across its aerospace systems, mission systems, defense systems, and space systems divisions, the company delivers resilient communication technologies for unmanned systems, cybersecurity, and tactical operations.

Emerging market participants include BAE Systems plc and Leonardo S.p.A:

- BAE Systems plc: BAE Systems is a global leader in defense and aerospace, offering advanced SDR technologies tailored for military applications. Its investments in R&D have produced systems such as the RAD5545, a radiation-hardened software radio engineered for secure communications in demanding environments.

- Leonardo S.p.A: Leonardo is a multinational aerospace and defense company specializing in secure communication and electronic warfare technologies. Its advanced SDR solutions support both military and civilian applications, enhancing interoperability and operational resilience across dynamic and complex environments.

Key Players

- L3Harris Technologies, Inc.

- RTX Corporation

- Thales Group

- General Dynamics Corporation

- Northrop Grumman Corporation

- BAE Systems Plc

- Elbit Systems Ltd.

- Leonardo S.p.A.

- Collins Aerospace

- Rafael Advanced Defense Systems Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global software defined radio market is set for robust growth as sectors increasingly rely on flexible, adaptive, and interoperable communication systems. With the market expanding from USD 29,491.4 million in 2024 to USD 47,753.9 million by 2030, SDR technology is becoming vital across defense, telecommunications, and public safety applications. Rising defense spending, modernization initiatives, and the advancement of 5G, IoT, and satellite communication are accelerating adoption worldwide.

As SDRs continue to enhance communication reliability, security, and multi-frequency adaptability, they will play an essential role in enabling next-generation communication infrastructures across both military and commercial domains.

No comments:

Post a Comment