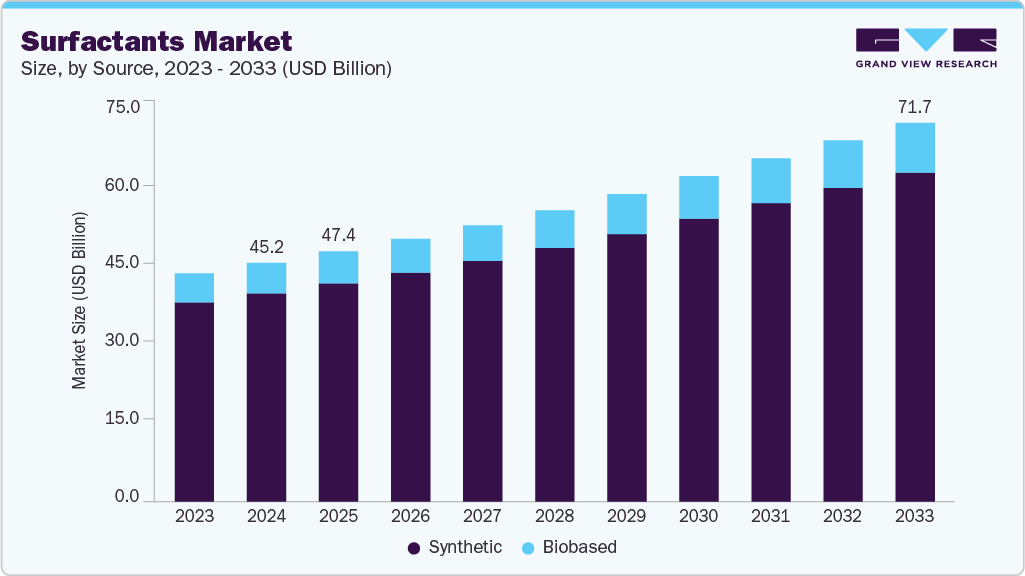

The global surfactants market size was valued at USD 45,199.4 million in 2024 and is forecast to reach USD 71,748.70 million by 2033, expanding at a CAGR of 5.3% from 2025 to 2033. The growing preference for surfactants globally continues to be shaped by their widening use across multiple industries and increasing consumer awareness of sustainable practices.

One of the primary drivers of market growth is the rising incorporation of renewable energy technologies and environmentally friendly product formulations. As consumers and regulatory bodies place greater emphasis on sustainability, demand for bio-based surfactants—derived from renewable raw materials—has increased significantly. These environmentally safe alternatives comply with global sustainability and product safety standards, motivating industries to transition toward greener formulations.

Surfactants also remain essential in key industries such as personal care, pharmaceuticals, and chemicals, where they perform critical functions including emulsifying, foaming, and dispersing. The personal care sector, in particular, has experienced strong growth in products such as shampoos, facial cleansers, and lotions, driven by heightened consumer focus on hygiene and grooming. Industrial and institutional cleaning applications have likewise expanded, as businesses seek high-performance formulations that meet strict hygiene and safety requirements.

Sectors including healthcare, hospitality, retail, and education are contributing to rising surfactant consumption, driven by the need for effective sanitation in high-contact environments. Surfactants play a vital role in breaking down oils, dirt, and microorganisms, making them indispensable in cleaning solutions. This wide range of applications, along with increasing interest in biodegradable and high-performance formulations, is creating a dynamic and competitive yet opportunity-rich market landscape. Continued investments in innovation and sustainable chemistry by leading manufacturers are expected to support the steady growth of the global surfactants market.

Order a free sample PDF of the Surfactants Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific held the largest market share at 35.07% in 2024. Rapid urbanization, rising disposable incomes, and growing awareness of hygiene and personal care are driving demand for detergents, shampoos, and surface cleaners in countries such as China and India. Major companies, including Unilever and P&G, are expanding operations to address the region’s increasing consumption. Growth in industries such as textiles, agriculture, and food processing further contributes to market expansion. Additionally, stricter environmental regulations are encouraging investment in bio-based and eco-friendly surfactant technologies.

- By source, the synthetic segment accounted for 87.5% of revenue in 2024, supported by low production costs and high availability. Anionic surfactants remain widely used due to their affordability and effectiveness in household detergents and cleaning products. However, concerns regarding environmental impact, including metal toxicity and poor degradability, pose challenges. Ongoing R&D efforts focused on improving environmental performance are expected to help address these issues and support future growth.

- By product, non-ionic surfactants held 13.5% of revenue in 2024. They are valued for their strong emulsifying, wetting, and dispersing abilities, along with chemical stability and compatibility with various formulations. Their mildness, low irritation potential, and biodegradability make them ideal for personal care and household cleaning applications. These features, combined with their alignment with environmental regulations, reinforce their dominant position in the market.

- By application, the homecare segment led with a 38.4% revenue share. The demand for laundry detergents, dishwashing liquids, surface cleaners, and disinfectants has surged due to growing hygiene awareness, particularly following the COVID-19 pandemic. Urbanization and rising middle-class populations in emerging economies have also boosted product usage. Manufacturers are increasingly developing eco-friendly and multifunctional cleaning solutions, further strengthening this segment.

Market Size & Forecast

- 2024 Market Size: USD 45,199.4 Million

- 2033 Projected Market Size: USD 71,748.7 Million

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

- BASF SE: BASF SE remains a global leader in surfactants, offering a broad portfolio for personal care, home care, industrial cleaning, and technical applications. Its eco-friendly surfactants—including Plantapon®, Texapon®, and Dehyton®—are known for biodegradability and renewable sourcing. BASF continues to emphasize sustainability by utilizing RSPO-certified palm oil and soy-based raw materials and investing in digital tools and innovative solutions for safer and more efficient formulation processes.

- Stepan Company: Stepan Company is one of the largest global producers of surfactants, supplying anionic, cationic, nonionic, and amphoteric surfactants, as well as customized blends. Its products serve the personal care, industrial cleaning, agriculture, and enhanced oil recovery sectors. The company operates 20 production sites and 14 R&D centers worldwide, supporting its strong market presence.

- Evonik Industries AG: Evonik Industries AG is emerging as a key player, particularly in sustainable surfactants. The company develops high-performance, bio-based surfactants using renewable materials and advanced fermentation technologies. These products are fully biodegradable, non-toxic, and skin-friendly, making them suitable for eco-conscious personal care and household applications. Evonik operates one of the few industrial-scale biosurfactant facilities in Europe, and its partnerships with major consumer brands reinforce its role as a leader in green surfactant innovation.

Key Players

- Akzonobel N.V

- BASF SE

- Evonik Industries AG

- Solvay S.A

- Clariant AG

- Huntsman International LLC

- Dow

- Kao Corporation

- Henkel Adhesives Technologies India Private Limited

- Bayer AG

- Godrej Industries Limited

- Stepan Company

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global surfactants market is on a robust growth trajectory, driven by expanding industrial applications, rising hygiene awareness, and the global shift toward sustainable and bio-based products. While synthetic surfactants continue to dominate due to cost efficiency and availability, increasing environmental concerns are accelerating innovation in greener alternatives. Asia Pacific remains the key growth engine, supported by urbanization and a rapidly expanding consumer base. With major companies investing heavily in sustainable chemistry and advanced formulations, the market is expected to achieve steady long-term growth, reaching USD 71,748.7 million by 2033 and maintaining a 5.3% CAGR through the forecast period.

No comments:

Post a Comment