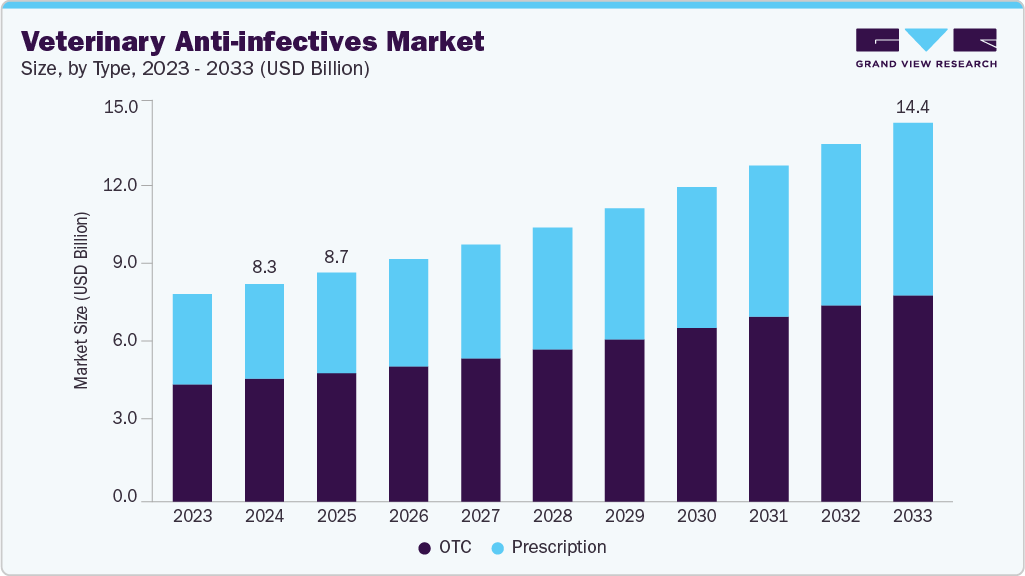

The global veterinary anti-infectives market was valued at USD 8.26 billion in 2024 and is expected to reach USD 14.37 billion by 2033, expanding at a CAGR of 6.5% from 2025 to 2033. Market growth is being driven by a rise in infectious diseases among animals, advancements in research initiatives, strengthened efforts to promote responsible antibiotic use, expanding regulatory approvals, and increasing applications of artificial intelligence (AI) in veterinary healthcare.

AI is emerging as one of the most influential factors shaping the market. Veterinary institutions, animal welfare organizations, and commercial players are implementing AI tools to improve clinical decision-making, enhance early diagnosis, identify treatment gaps, and accelerate veterinary drug development. AI also supports predictive modeling for outbreak surveillance, helping optimize anti-infective usage amid rising concerns regarding antimicrobial resistance (AMR).

The global prevalence of infectious diseases in both companion and livestock animals is contributing significantly to market demand. For example, India experienced a severe Lumpy Skin Disease outbreak in 2023, affecting 2.95 million cattle and causing more than 155,000 deaths across 15 states. In the U.S., a major beef-producing country, highly pathogenic avian influenza (HPAI) was detected in over 250 beef samples from 38 states as of May 2024. South Africa reported a 30% decline in egg production in 2023 and culled over one million poultry due to HPAI. These incidents underscore the growing need for effective anti-infective therapies.

AMR is prompting enhanced global regulatory measures. In June 2025, India’s Central Drugs Standard Control Organisation (CDSCO) initiated a nationwide framework to monitor antimicrobial use (AMU) in livestock. The initiative includes mandated reporting, cross-agency collaboration, and stricter oversight—steps expected to accelerate demand for more targeted and compliant anti-infective solutions.

Order a free sample PDF of the Veterinary Anti-infectives Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America held 35.69% of the global market share in 2024. The region’s growth is fueled by established key players and increasing veterinary treatment costs. According to zoonotic disease data, six in ten human infectious diseases originate from animals, while three out of four emerging infectious diseases stem from animal sources. These patterns reinforce demand for veterinary anti-infectives across the region.

- By Animal Type: The livestock segment accounted for 63.57% of the market in 2024. Fish, poultry, swine, cattle, goats, and sheep all face heavy disease burdens, necessitating routine anti-infective usage. Rising demand for animal protein continues to drive this segment. For instance, India’s meat production reached 10.25 MMT in 2023–24, up 4.95% from the previous year, with poultry surpassing 5 MMT and buffalo meat reaching 4.57 MMT.

- By Product: Antimicrobials held approximately 51% of the market share in 2024. Cephalosporins, tetracyclines, penicillins, and macrolides remain essential for managing bacterial respiratory, gastrointestinal, and systemic infections. Concerns over zoonotic diseases and AMR have prompted stricter regulatory oversight, sustaining demand for responsible and innovative antimicrobial therapies.

- By Route of Administration: The oral segment dominated with a 71.04% share in 2024. Oral formulations such as chewables, liquids, and tablets facilitate easier administration, allow mass treatment through feed or water, and improve compliance, particularly in large livestock populations.

- By Type: The prescription segment is expected to record the highest CAGR over the forecast period. Increasing regulatory restrictions on over-the-counter (OTC) veterinary drugs are driving greater reliance on prescription-based anti-infectives.

- By Distribution Channel: Retail pharmacies led the market in 2024. Their strong distribution networks, trusted regulatory compliance, and accessibility support high adoption levels. Ongoing digitization is further expected to enhance accuracy, reduce prescription errors, and expand the availability of veterinary medications.

Market Size & Forecast

- 2024 Market Size: USD 8.26 Billion

- 2033 Projected Market Size: USD 14.37 Billion

- CAGR (2025-2033): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The veterinary anti-infectives market operates under strict regulatory governance from agencies such as the USFDA, EU authorities, and the CDSCO, especially as concerns around AMR increase. Major players including Zoetis and Boehringer Ingelheim dominate the market, though regional manufacturers and cost-effective alternatives remain relevant. Startups are also entering the space with targeted, resistance-bypassing therapies.

Strategic initiatives continue to shape the competitive landscape. Zoetis’ acquisition of Anchor 300 strengthened its cattle-focused product line, while Agrovet Market introduced specialized intramammary antibiotics to address dairy-sector needs. Consolidation is also occurring in the distribution space, as seen with Pharmacy2U’s acquisition of PharmPet Co., which aims to enhance digital accessibility for veterinary medications.

Key Players

- Zoetis

- Boehringer Ingelheim

- Merck & Co. Inc.

- Dechra Pharmaceuticals Plc.

- Elanco Animal Health

- Ceva Sante Animale

- Virbac

- Biogénesis Bagó

- Vetoquinol

- Calier

- Norbrook Laboratories

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The veterinary anti-infectives market is positioned for strong growth as global disease outbreaks in animals rise, regulatory scrutiny intensifies, and technological innovations continue to advance diagnostics and treatment. Growing from USD 8.26 billion in 2024 to USD 14.37 billion by 2033, the market will be shaped by increased demand for livestock healthcare, the expanding role of AI in veterinary decision-making, and global efforts to combat antimicrobial resistance. With North America leading and Asia Pacific emerging rapidly, sustained investment in targeted therapies, regulatory compliance, and digital transformation will remain essential to meeting the evolving needs of veterinary medicine.

No comments:

Post a Comment