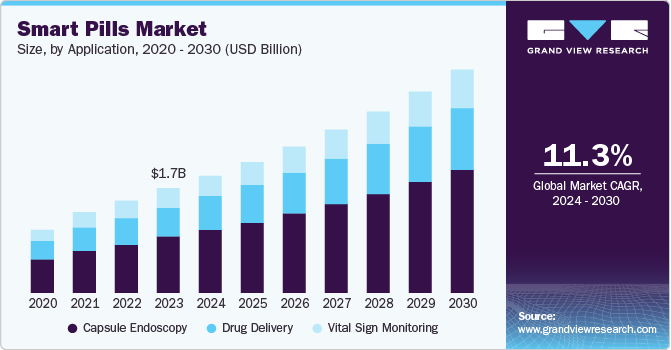

The global smart pills market was valued at USD 1.7 billion in 2023 and is expected to grow to USD 3.64 billion by 2030, representing a compound annual growth rate (CAGR) of 11.3% from 2024 to 2030. Smart pills, also known as digital pills or ingestible sensors, combine pharmaceutical treatments with digital monitoring capabilities. These pills contain miniature sensors that transmit data regarding the body’s response to medication—such as vital signs or medication adherence—to devices like smartphones or computers. This real-time data enables healthcare providers to adjust treatment plans with greater precision and intervene when necessary.

Several factors are driving the market for smart pill technologies, including favorable reimbursement policies, increasing patient demand for less invasive treatments, advancements in endoscopic procedures, and the rising incidence of conditions like colon cancer. The technology’s ability to provide breakthroughs in diagnostic procedures, targeted drug delivery, and remote patient monitoring further contributes to market growth. Additionally, patients’ preference for non-invasive diagnostics, combined with the rise in chronic diseases and aging populations, has fueled the adoption of smart pills. The integration of artificial intelligence with smart pill technologies enhances data analytics, enabling faster and more accurate diagnoses, treatments, and preventive care.

Order a free sample PDF of the Smart Pills Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America: In 2023, North America led the global smart pills market with a share of 37.5%, driven by the increasing prevalence of chronic diseases, particularly gastrointestinal disorders and related cancers. The region’s openness to adopting advanced technologies and its regulatory environment, including FDA approvals for innovative health monitoring devices, has also supported market growth. The presence of major industry players in the region further encourages product development.

- Application: Capsule endoscopy was the largest application segment, holding 54.1% of the market share in 2023. This non-invasive procedure, which involves swallowing a small pill-sized capsule equipped with wireless cameras and sensors, is used to diagnose gastrointestinal disorders. The procedure’s minimal discomfort and quick recovery time make it an attractive diagnostic method, driving demand for smart pill technologies.

- Disease Indication: In 2023, celiac disease dominated the disease indication segment, benefiting from the rising prevalence of gastrointestinal disorders and chronic diseases like cancer and diabetes. The growing elderly population and the increasing demand for minimally invasive procedures have also driven the popularity of smart pills for diagnosis and treatment.

- Target Area: The small intestine was the leading target area in 2023, accounting for the largest revenue share. This was due to the increasing incidence of disorders such as Crohn’s disease and celiac disease, which affect the small intestine. Additionally, traditional diagnostic methods face challenges in examining the small intestine, making smart pills a highly effective alternative.

- End-use: Outpatient facilities held the largest share of the market at 53.3% in 2023, driven by the growing demand for accurate medicines and government initiatives to promote automated medication technologies. These factors have made smart pills particularly popular in outpatient care and among lower-risk patients who require less intensive care.

Market Size & Forecast

- 2023 Market Size: USD 1.7 Billion

- 2030 Projected Market Size: USD 3.64 Billion

- CAGR (2024-2030): 11.3%

- North America: Largest market in 2023

Key Companies & Market Share Insights

Leading companies in the smart pills market include Medtronic, Otsuka Holdings Co., Ltd., Olympus Corporation, CapsoCam Plus, Pentax Medical, JINSHAN Science & Technology (Group) Co., Ltd., and Check-Cap Ltd. These companies are focusing on product development and strategic initiatives to gain a competitive advantage. Notable innovations include:

- Medtronic: The company offers the PillCam technology, a non-invasive imaging capsule for the gastrointestinal tract, which aids in diagnosing disorders such as colorectal cancer.

- Olympus: Olympus is focusing on advanced imaging technologies, including capsule endoscopes, which capture high-quality visual data from the gastrointestinal tract to aid in early disease detection.

Key Players

- Medtronic

- Otsuka Holdings Co., Ltd.

- Olympus Corporation

- CapsoCam Plus

- Pentax Medical

- JINSHAN Science & Technology (Group) Co., Ltd.

- Check-Cap Ltd.

- etectRx

- INTROMEDIC

- Shenzen Jifu Medical Technology Co., Ltd

- BodyCapUSA

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The smart pills market is experiencing substantial growth, driven by advances in non-invasive diagnostic techniques, patient demand for personalized treatment, and the increasing prevalence of chronic and gastrointestinal diseases. The market is expected to continue expanding, particularly in regions like North America, where regulatory support and technological innovation are strong. As AI integration and new sensor technologies enhance the capabilities of smart pills, their role in modern healthcare—ranging from diagnosis to treatment and patient monitoring—will likely become even more critical.

No comments:

Post a Comment