The global steel rebar market was valued at USD 243.46 billion in 2024 and is forecast to reach USD 325.32 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. Increased government spending on infrastructure development as a means to stimulate economic growth is expected to significantly support market expansion.

For example, in the first quarter of 2023, China accelerated infrastructure investment, initiating more than 10,000 new projects across sectors such as advanced manufacturing, water conservation, transportation, modern services, and next-generation infrastructure. Likewise, the U.S. government has outlined plans to repair major highways and 45,000 bridges, allocating USD 110.00 billion for infrastructure reconstruction. Additional funding is also being directed toward the development of ports, water systems, and airports, which is expected to elevate steel rebar demand in the U.S. throughout the forecast period.

Investments in manufacturing facilities are also set to bolster market growth. For instance, in December 2023, Waaree Energy announced plans to establish a solar module manufacturing facility in Brookshire, U.S., with an expected annual production capacity of 3 gigawatts (GW). Operations are anticipated to begin by the end of 2024, and the company intends to scale its solar module capacity to 5 GW by 2027, according to its website.

Order a free sample PDF of the Steel Rebar Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- The Asia Pacific steel rebar market is expected to experience strong growth during the forecast period due to increasing construction investments, particularly in China and India. In India’s Union Budget 2025, the government announced new affordable housing initiatives, targeting the completion of 40,000 housing units in 2025–26 to support families with home loans.

- Growing investments in the construction sector are anticipated to boost segment demand. India’s real estate industry attracted USD 11.4 billion in equity investments in 2024—an increase of 54% compared to 2023. Rising demand for steel rebar in the construction of manufacturing facilities is another key growth driver. For example, in February 2025, Uniphar announced the expansion of three new facilities in Ireland, the Netherlands, and the U.S., supporting its product portfolio across the pharmaceutical and biotech sectors.

- The infrastructure application segment is projected to register the fastest CAGR over the forecast period. Increased government spending aimed at revitalizing economies following the pandemic is a major contributor. As reported by Indonesia’s Ministry of Finance, the country invested USD 29.40 billion in infrastructure in 2023, compared to USD 24.04 billion in 2022—representing growth of nearly 22%.

Market Size & Forecast

- 2024 Market Size: USD 243.46 Billion

- 2030 Projected Market Size: USD 325.32 Billion

- CAGR (2025-2030): 5.7%

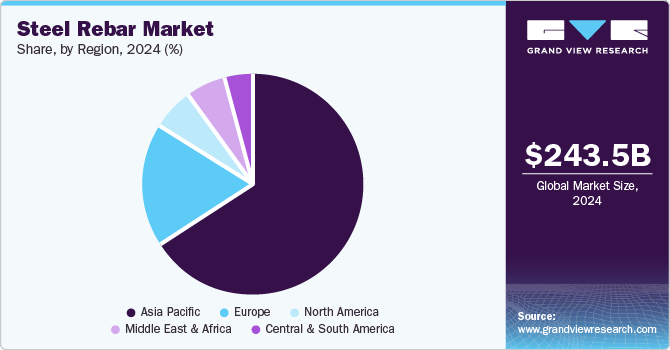

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Key players in the steel rebar market include ArcelorMittal, Nippon Steel Corporation, Baowu Group, and Tata Steel.

- ArcelorMittal, formed through the merger of Mittal Steel Company N.V. and Arcelor in 2007, is an integrated steel and mining company headquartered in Luxembourg. It produces a wide portfolio of finished and semi-finished steel products, including sheet and plate, as well as long products such as bars, rods, and structural shapes.

- Nucor is a major steel producer and recycling company operating across three segments: steel mills, raw materials, and steel products. Its steel mills segment includes bar, sheet, structural, and plate mills, while its steel products segment offers reinforcing products, steel mesh, fasteners, open-web joists, joist girders, decks, metal buildings, components, and cold-finished bar products.

Key Players

- ArcelorMittal

- NIPPON STEEL CORPORATION

- NLMK

- Nucor

- Tata Steel

- JSW

- POSCO HOLDINGS INC.

- Jiangsu Shagang Group

- SAIL

- Steel Dynamics, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global steel rebar market is set for steady growth driven by large-scale infrastructure investments worldwide, particularly in emerging and developed economies aiming to enhance transportation networks, public utilities, and industrial capacity. Government-backed initiatives in China, the U.S., India, and Indonesia underscore the central role of steel rebar in construction and economic development. Additionally, rising investments in manufacturing facilities and renewable energy projects further strengthen market demand. With Asia Pacific leading the market and infrastructure applications expanding rapidly, steel rebar will continue to be a foundational material supporting global development through 2030.

No comments:

Post a Comment