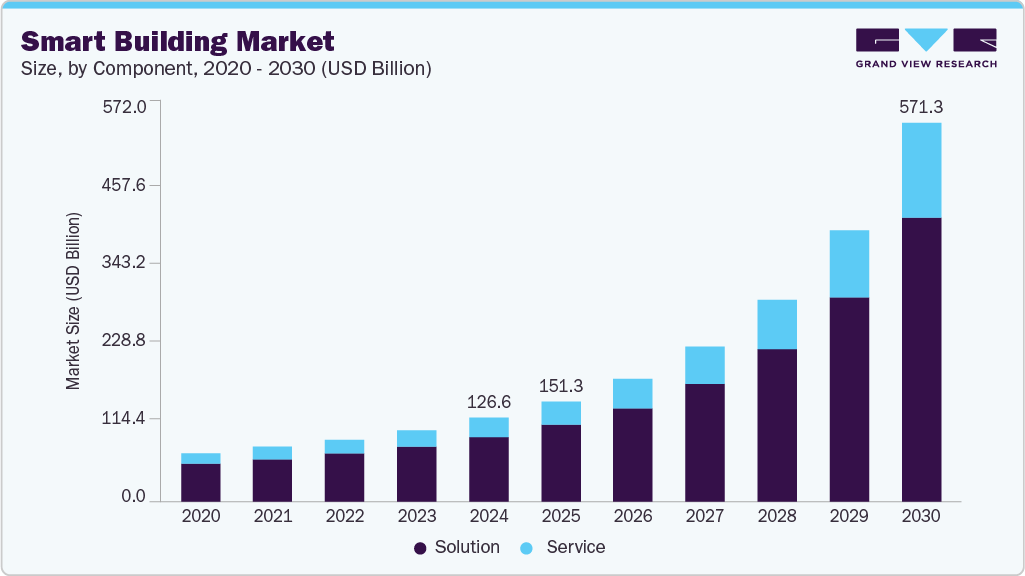

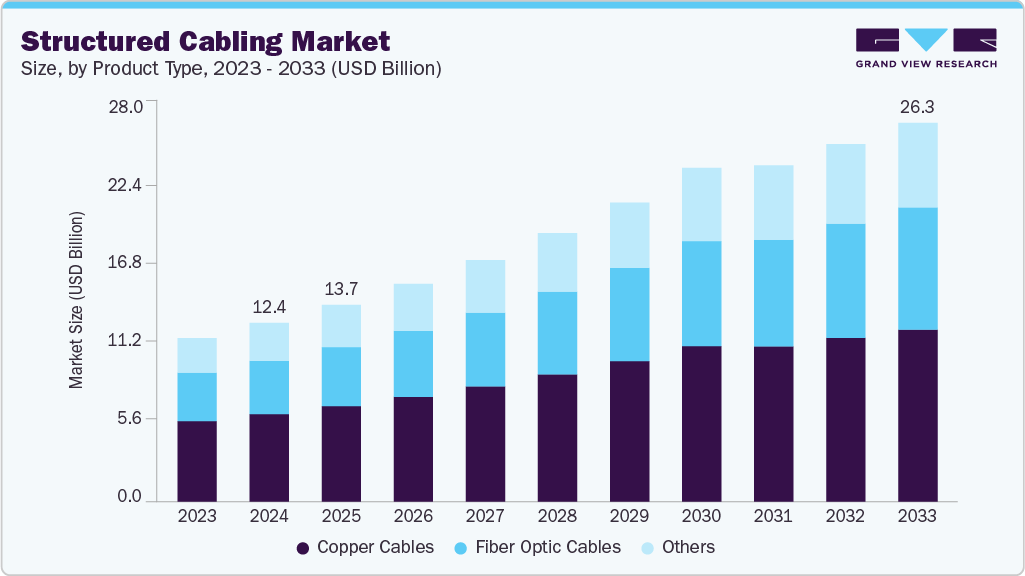

The global structured cabling market was valued at USD 12,412.1 million in 2024 and is expected to reach USD 26,300.3 million by 2033, expanding at a CAGR of 8.5% from 2025 to 2033. The market includes a wide variety of cables and hardware components that serve as the foundation of modern telecommunication networks.

Structured cabling systems enable the transmission of voice, video, and data signals across network environments. Reliable connectivity depends on the integration of multiple cabling systems and connection devices that support seamless communication. These systems are essential for creating scalable, efficient, and easily manageable network infrastructures across enterprise settings.

Service providers are increasingly offering complete, end-to-end integration—including deployment, consultation, and continuous support—by combining global hardware with local service delivery. This approach helps streamline network management and allows faster implementation. A notable example occurred in November 2024, when TechAccess in Dubai partnered with Siemon to deliver high-performance structured cabling and IT infrastructure solutions in South Africa, offering advanced passive network technologies for data centers and smart buildings.

The market is also experiencing a strong shift toward high-speed transmission solutions such as Cat 6A, Cat 7, and fiber-optic cabling. This transition is driven by rapid growth in cloud computing, AI applications, and high-definition video streaming. These advanced systems offer improved bandwidth, reduced interference, and enhanced data integrity—making them ideal for enterprise-scale networks and hyperscale data centers. As organizations expand their IT infrastructure to support increasing device density and real-time data processing, older cabling standards are being replaced with future-ready, high-performance systems.

Order a free sample PDF of the Structured Cabling Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America led the global structured cabling market in 2024 with a 34.2% share. High adoption of advanced IT infrastructure, strong presence of data centers and tech firms, and ongoing digital transformation initiatives fueled regional demand. Government-backed smart city programs also supported widespread infrastructure upgrades.

- By product type, copper cables held a 48.9% share in 2024, maintaining a dominant market position due to their cost efficiency, ease of installation, and reliability. Copper solutions remain widely used in commercial buildings and legacy systems where short-distance transmission is sufficient. Their continued relevance stems from mature manufacturing processes and broad compatibility across enterprise networks.

- The LAN segment accounted for 80.8% of market revenue in 2024, driven by extensive use in office buildings, educational institutions, and enterprise campuses. LAN deployments rely heavily on copper cabling for reliable short-distance connectivity. Standardized designs, integration with IP-based systems, and ongoing network upgrades contribute to sustained demand.

- By vertical, the IT & Telecommunications sector is expected to grow at the fastest rate—9.7% CAGR from 2025 to 2033—due to expanding cloud adoption, 5G rollout, and the need for high-bandwidth infrastructure. Telecom operators are enhancing backbone networks and data centers, while IT organizations invest in scalable systems to support automation and real-time analytics.

Market Size & Forecast

- 2024 Market Size: USD 12,412.1 Million

- 2033 Projected Market Size: USD 26,300.3 Million

- CAGR (2025-2033): 8.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Major participants in the structured cabling industry include ABB Ltd, Belden Inc., Corning Incorporated, Furukawa Electric Co., Ltd., Legrand SA, and TE Connectivity Ltd. Companies are working to expand their customer base and competitive position through partnerships, mergers, acquisitions, and broader product offerings.

- ABB Ltd is strengthening its structured cabling presence by integrating electrical and data systems for smart buildings. The company continues to expand its modular cabling solutions focused on scalability, high-speed performance, and energy-efficient designs.

- Corning Incorporated is advancing high-performance fiber-optic systems built for data centers and hyperscale environments. Solutions such as EDGE™ and EDGE8® emphasize modularity and rapid deployment, supporting AI workloads, 5G expansion, and edge computing. Corning is also partnering with service providers to accelerate digital infrastructure development.

Key Players

- ABB Ltd

- Belden Inc.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Furukawa Electric Co., Ltd.

- Legrand SA

- Nexans

- Schneider Electric

- Siemens AG

- TE Connectivity Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global structured cabling market is set for substantial growth as organizations modernize their IT infrastructure to support rising data demands and digital transformation initiatives. Increasing adoption of cloud computing, AI, and high-speed connectivity is accelerating the shift toward advanced cabling systems such as Cat 6A, Cat 7, and fiber optics. North America maintains a leading position due to mature technological ecosystems, while Asia Pacific is emerging as the fastest-growing region. With expanding data center footprints and growing reliance on real-time communication technologies, demand for scalable, high-performance structured cabling solutions will continue to rise through 2033.