The global luxury jewelry market was valued at USD 49.1 billion in 2024 and is projected to reach USD 82.1 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. A key driver behind this growth is the rising consumer demand for sustainable and gender-fluid jewelry, alongside a broader shift toward personalization and self-expression.

Modern consumers are increasingly viewing luxury jewelry as a medium for individual identity and creativity, with growing interest in non-traditional designs, materials, and aesthetics. Collections now frequently feature asymmetrical cuts, gemstone imperfections, opaque gems, and utilitarian styles, all of which appeal to buyers seeking meaningful, distinctive pieces.

Pearl jewelry has also gained renewed popularity, receiving public endorsements from influential figures such as former U.S. Vice President Kamala Harris, celebrities in the film and music industries, and British Royal Family members, who have showcased such pieces at high-profile events.

The blurring of gender boundaries in fashion is also influencing jewelry design. Brands are expanding into unisex and gender-neutral collections, reflecting a cultural shift. For instance, Gucci markets jewelry to all genders, while Bulgari’s B.Zero 1 Rock line features sleek, modern pieces designed for universal appeal. Additionally, designers like Shaun Leane are pioneering gender-inclusive engagement rings, addressing a growing demand from LGBTQ+ couples.

Generation Z, known for resisting traditional labels, plays a significant role in these shifts. This generation’s openness to fluidity and inclusivity allows brands to market their products across a broad spectrum of consumers and occasions.

Order a free sample PDF of the Luxury Jewelry Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific led the global luxury jewelry market in 2024, holding a 66.6% revenue share. This dominance is fueled by the region’s cultural affinity for jewelry, where it plays a significant role in traditions, ceremonies, and celebrations. In response, luxury brands are incorporating regional influences to better connect with APAC consumers.

- By Raw Material: The gold segment held the largest revenue share of 33.1% in 2024. Gold remains a preferred material due to its cultural significance, timeless appeal, and its reputation as a secure investment, especially during periods of economic uncertainty.

- By Product: The rings segment dominated the market in 2024, driven by the emotional and symbolic value of rings in engagements, weddings, and other significant life events. Their high degree of customization further supports their popularity.

- By Distribution Channel: The offline retail channel led in 2024, accounting for the largest revenue share. Despite increased online browsing, the majority of consumers still prefer to purchase luxury jewelry in-store. A 2021 survey found that although many shoppers browse online, only 15–20% complete jewelry purchases digitally.

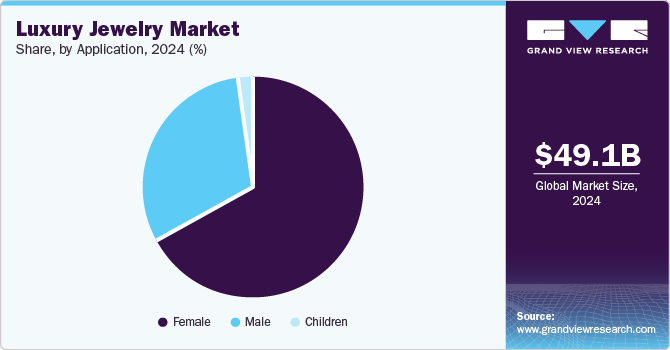

- By Application: The female segment represented the highest revenue share in 2024. Jewelry remains a powerful cultural and emotional symbol for many women, often linked to identity, social status, and personal milestones such as anniversaries and weddings. Scientific studies have also linked jewelry-wearing to the release of dopamine, enhancing mood and well-being.

Market Size & Forecast

- 2024 Market Size: USD 49.1 Billion

- 2030 Projected Market Size: USD 82.1 Billion

- CAGR (2025-2030): 8.7%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Leading luxury jewelry brands continue to focus on craftsmanship, exclusivity, and adaptation to evolving consumer values. Companies such as Guccio Gucci S.p.A., The Swatch Group Ltd, Compagnie Financière Richemont SA, and T&CO. remain at the forefront, leveraging celebrity partnerships, digital innovation, and sustainable practices to engage a modern, diverse consumer base.

- Guccio Gucci S.p.A. - Known globally for its luxury image, Gucci offers a wide range of jewelry pieces, including earrings, bracelets, necklaces, and rings—crafted with fine materials and avant-garde design.

- The Swatch Group Ltd - A major Swiss conglomerate, Swatch Group designs and distributes luxury watches and jewelry under renowned brands such as Omega, Longines, and Breguet. The company is recognized for its high-quality craftsmanship and heritage in luxury timepieces.

Key Players

- Guccio Gucci S.p.A.

- The Swatch Group Ltd

- Compagnie Financière Richemont SA

- T&CO.

- GRAFF

- LOUIS VUITTON

- Signet Jewelers.

- Chopard

- MIKIMOTO

- Pandora

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global luxury jewelry market is experiencing dynamic growth, fueled by rising demand for individualized, sustainable, and gender-inclusive designs. With a projected CAGR of 8.7% through 2030, the market is poised for sustained expansion, reaching over USD 82 billion. While Asia Pacific leads in market share due to its cultural ties to jewelry, global consumer behavior is evolving toward inclusivity and self-expression.

Luxury brands are responding through innovation, personalization, and ethical sourcing, ensuring they remain relevant to younger, more socially conscious generations. As the lines between fashion, identity, and purpose continue to blur, luxury jewelry will increasingly serve not just as adornment—but as a reflection of personal values and cultural evolution.

No comments:

Post a Comment