The China lung cancer screening market was valued at USD 505.17 million in 2023 and is projected to reach USD 1,041.58 million by 2030, growing at a CAGR of 11.09% from 2024 to 2030. This growth is driven by several key factors, including the high incidence of lung cancer, advancements in screening technologies, supportive government initiatives, and increased awareness about the importance of early detection. According to the Shanghai Municipal People's Government, lung cancer is one of the most common and deadliest cancers in China, with approximately 800,000 new cases reported annually. Alarmingly, around 70% of these patients are diagnosed at advanced or terminal stages, underscoring the urgent need for effective screening to enhance early diagnosis and treatment outcomes.

As reported by the Journal of Thoracic Oncology, lung cancer is the leading cause of cancer-related mortality in China, responsible for nearly 19.2% of all deaths. This high prevalence drives strong demand for efficient screening and early detection methods. A study published by the National Library of Medicine in July 2023 attributes the heavy lung cancer burden partly to China’s large population. China has the largest number of smokers worldwide, consuming about 40% of the global tobacco supply annually. Moreover, approximately 70% of the population is exposed to secondhand smoke each year, contributing to an estimated 60,000 lung cancer deaths annually. This severe public health challenge fuels the demand for advanced lung cancer screening solutions aimed at mitigating the disease's impact.

The COVID-19 pandemic notably influenced the market in China by accelerating the adoption of advanced diagnostic tools. Heightened awareness of respiratory health during the pandemic increased focus on early lung cancer detection. Given the overlapping symptoms of lung cancer and COVID-19—such as persistent coughing and chest discomfort—screening demand rose significantly. According to the National Library of Health estimates, China accounted for the highest number of COVID-19 cases and mortality globally (37.0% and 39.8%, respectively) in 2020. The strain the pandemic placed on healthcare systems emphasized the need for accurate and early diagnostics capable of differentiating between COVID-19 and lung cancer. This led to greater investments in screening technologies like low-dose spiral CT scans, proven effective in identifying lung cancer at early stages.

Order a free sample PDF of the China Lung Cancer Screening Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Cancer Type: Non-small cell lung cancer (NSCLC) dominated the market in 2023, accounting for 81.29% of the share. This is attributed to its high prevalence, advancements in diagnostic technology, supportive government policies, and improved healthcare infrastructure. NSCLC is particularly widespread in China due to high smoking rates and environmental pollution, which contribute significantly to the disease burden.

- By Diagnosis Method: Low Dose Spiral CT (LDCT) scans held the largest share of 70.69% in 2023 and are expected to exhibit the fastest growth during the forecast period. LDCT is widely recognized for its ability to detect lung cancer at an early stage, especially in high-risk groups such as long-term smokers and individuals exposed to carcinogens.

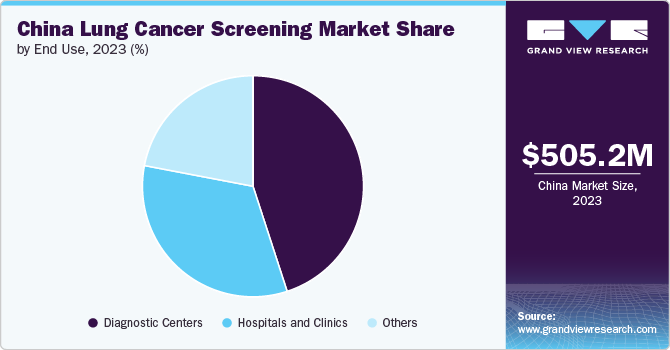

- By End Use: Diagnostic centers accounted for the largest market share at 45.36% in 2023. These centers are specialized facilities equipped with advanced imaging technologies and staffed by skilled medical professionals, providing comprehensive diagnostic services including LDCT scans, which are critical for early lung cancer detection.

Market Size & Forecast

- 2023 Market Size: USD 505.17 Million

- 2030 Projected Market Size: USD 1,041.58 Million

- CAGR (2024-2030): 11.09%

Key Companies & Market Share Insights

The competitive landscape of the China lung cancer screening market is robust, featuring key players such as Biodesix, DELFI Diagnostics, Inc., GE HealthCare, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Siemens Healthineers AG, Koninklijke Philips N.V., CANON MEDICAL SYSTEMS CORPORATION, Medtronic, Shanghai United Imaging Healthcare Co., Ltd., and Freenome Holdings, Inc. These companies are actively pursuing strategies including new product development, mergers and acquisitions, collaborations, and regional expansion to meet the unmet needs of their customers.

Key Players

- Biodesix

- DELFI Diagnostics, Inc.

- GE HealthCare

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- Medtronic

- Shanghai United Imaging Healthcare Co., LTD

- Freenome Holdings, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The China lung cancer screening market is set for significant growth through 2030, propelled by the country’s high lung cancer prevalence, advancements in screening technologies, and supportive government policies. The COVID-19 pandemic further accelerated demand for early and accurate diagnostic solutions, highlighting the importance of differentiating lung cancer from other respiratory illnesses. Non-small cell lung cancer remains the primary focus due to its high occurrence, and technologies like low-dose spiral CT scans are becoming standard in early detection efforts. With strong competition among leading players and ongoing innovation, the market is well-positioned to improve lung cancer diagnosis and treatment outcomes, ultimately reducing the disease’s public health burden in China.

No comments:

Post a Comment