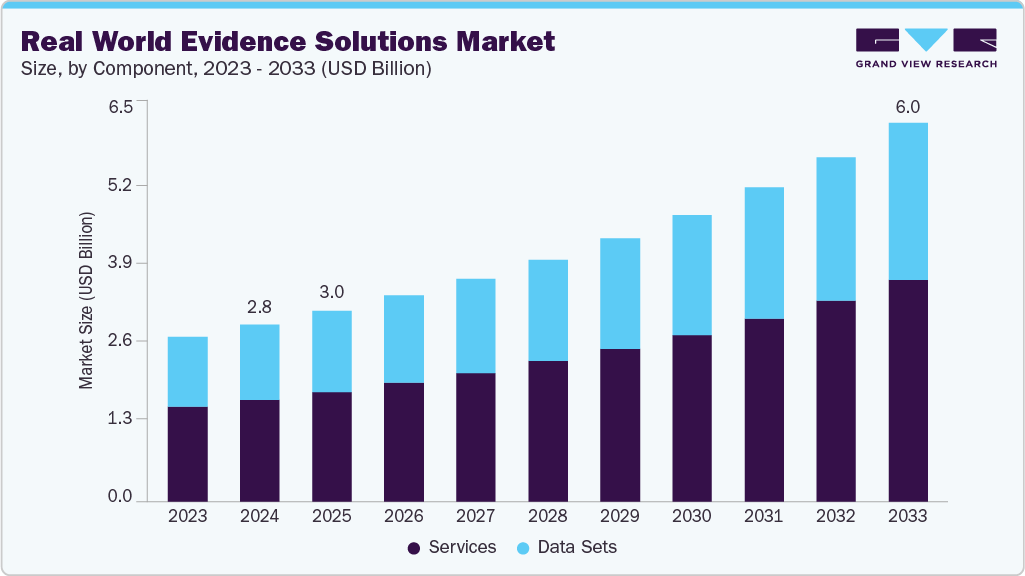

The global real-world evidence (RWE) solutions market was valued at USD 2.81 billion in 2024 and is expected to reach USD 6.01 billion by 2033, growing at a CAGR of 8.94% from 2025 to 2033. Market growth is driven by rising R&D expenditure, expanding applications of real-world evidence across multiple healthcare domains, increasing regulatory support for the use of RWE solutions, and the rapidly growing volume of real-world data.

Growing regulatory acceptance of real-world evidence is a major factor supporting market expansion. Regulatory agencies worldwide are providing clearer guidance on how real-world data (RWD) can be used to support product approvals, label expansions, and post-market evaluations. This improved regulatory clarity reduces compliance risks and encourages pharmaceutical and biotechnology companies to invest in advanced RWE platforms. Key regulatory initiatives facilitating RWE adoption include:

- FDA (U.S.) – Through the 21st Century Cures Act and dedicated RWE guidance, the FDA defines how electronic health records, claims data, and registries can be used in regulatory submissions, along with requirements for data quality and methodological validation.

- EMA (EU) – The EMA’s DARWIN EU network, RWE Roadmap, and Data Quality Framework standardize the use of RWD across Europe, enabling consistent integration of RWE throughout the product lifecycle.

- MHRA (UK) – The MHRA provides detailed guidance on RWD-based studies and randomized controlled trials using RWD, specifying acceptable data sources, endpoints, and safety processes through its RWE Scientific Dialogue pathway.

- PMDA (Japan) – The PMDA emphasizes data reliability and analytical rigor while increasingly accepting registry-based evidence for approvals and label updates, particularly in rare and pediatric indications.

These regulatory initiatives are strengthening industry confidence in real-world evidence methodologies, thereby accelerating the global adoption of RWE solutions.

The rapid growth in the volume of real-world data is another key driver of the RWE solutions market. Health-related data is expanding at a compound annual growth rate of approximately 36%, driven by the widespread use of electronic health records, insurance claims, disease registries, wearable devices, and patient-reported outcomes. Advances in data integration, interoperability, and analytics enable RWE platforms to convert these large and complex datasets into actionable insights. This capability allows pharmaceutical companies, payers, and healthcare providers to generate more accurate and timely evidence to support drug development, regulatory decision-making, and value-based care models.

Order a free sample PDF of the Real World Evidence Solutions Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America dominated the real-world evidence solutions market with a revenue share of 43.17% in 2024. This leadership is supported by strong regulatory backing for RWE use, increasing R&D investments, and the ongoing transition from volume-based to value-based healthcare. The presence of major RWE solution providers in the U.S. and Canada, along with favorable government policies and a growing number of service providers, further contributes to regional market growth.

- By Component, the services segment held the largest market share of 57.73% in 2024. High adoption of real-world evidence services by pharmaceutical and biotechnology companies and healthcare providers is a major factor driving this segment. Strategic initiatives by industry players also support growth. For example, in February 2024, Gilead Sciences, Inc. announced plans to present real-world evidence and new clinical data from its antiviral R&D programs at the 31st Conference on Retroviruses and Opportunistic Infections (CROI 2024).

- By Application, the drug development and approvals segment accounted for the largest revenue share of 28.61% in 2024. RWE solutions support efficient operational management and accelerate drug development and approval timelines for pharmaceutical companies, healthcare providers, and payers. Government initiatives further promote the use of RWE in medical device development and approvals. For instance, in December 2023, the FDA released draft guidance describing its evaluation of RWD in medical device clearance and approval decisions, supported by anonymized case examples.

- By Therapeutic Area, the oncology segment held the largest revenue share of 22.93% in 2024. Growth in this segment is driven by the extensive use of RWE in cancer drug development to reduce clinical trial costs, improve regulatory success rates, and shorten approval timelines. According to GLOBOCAN, approximately 10.0 million new cancer cases and 9.7 million cancer-related deaths were recorded globally in 2022. In India, cancer incidence increased from 1.39 million cases in 2020 to 1.46 million cases in 2022, as reported by the Indian Council of Medical Research. The rising global cancer burden continues to accelerate the adoption of RWE solutions in oncology research.

- By End Use, healthcare companies held the dominant market share in 2024. This growth is attributed to the increasing importance of RWE studies in drug approvals, the need to minimize costly drug recalls, and the growing demand to assess product performance in real-world clinical settings. For example, in February 2024, PINC AI Applied Sciences, a division of Premier, Inc., and Datavant expanded their collaboration to strengthen healthcare research, enhance clinical trial operations, and promote trial diversity and equity.

Market Size & Forecast

- 2024 Market Size: USD 2.81 Billion

- 2033 Projected Market Size: USD 6.01 Billion

- CAGR (2025-2033): 8.94%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key participants in the real-world evidence solutions market are adopting advanced strategies such as AI-driven analytics, predictive modeling, patient stratification, and automated outcomes reporting to improve research efficiency and decision-making. Integration with interoperable healthcare IT systems, electronic health records, claims databases, and collaborations with biopharmaceutical companies, payers, and research organizations are further expanding the adoption and reach of RWE solutions.

Key Players

- IQVIA

- Merative

- PPD Inc. (now part of Thermo Fisher)

- Parexel International Corporation

- NTT DATA, Inc.

- Icon Plc

- Oracle

- Syneos Health

- Cegedim Health Data

- Medpace

- Optum Inc. (UnitedHealth Group)

- SAS Institute Inc.

- Cognizant

- Aetion, Inc. (acquired by Datavant in May 2025)

- Flatiron Health

- Cytel Inc.

- Trinity

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The real-world evidence solutions market is poised for sustained growth through 2033, supported by increasing regulatory acceptance, rising R&D investments, and the exponential growth of healthcare data. Continued advancements in analytics, interoperability, and AI-enabled platforms are enhancing the value of RWE across drug development, regulatory decision-making, and real-world clinical evaluation. With North America maintaining market leadership and Asia Pacific emerging as the fastest-growing region, RWE solutions are expected to play an increasingly critical role in shaping data-driven, value-based healthcare worldwide.

No comments:

Post a Comment