The global amphibious vehicle market was valued at USD 3.96 billion in 2024 and is projected to grow to USD 6.47 billion by 2030, expanding at a CAGR of 8.6% from 2025 to 2030. This growth is primarily driven by increased defense investments focused on improving tactical mobility and command capabilities, as well as the growing adoption of amphibious vehicles by disaster management agencies responding to more frequent climate-related emergencies.

Moreover, infrastructure development in flood-prone and waterlogged regions is creating strong demand for amphibious excavators and utility vehicles among construction and dredging contractors. However, high production and operational costs associated with the development and maintenance of amphibious vehicles remain a significant challenge. On the other hand, the increasing interest in amphibious transportation solutions for tourism and intermodal passenger mobility represents a promising growth opportunity, especially in areas investing in water-based transport infrastructure.

The ongoing defense modernization efforts continue to reinforce the demand for advanced amphibious armored vehicles designed for multi-domain operations. A notable example is the U.S. Marine Corps’ acceptance of the ACV-Command and Control (ACV-C) variant in January 2025, which serves as a mobile battlefield command center. Similar modernization programs around the world are focusing on mobility, survivability, and network-enabled capabilities for amphibious platforms. As legacy fleets are retired, defense procurement strategies are increasingly centered on modular vehicles capable of both sea and land operations, making next-generation amphibious armored units vital for modern military forces.

In addition, the increasing frequency of climate-induced disasters is accelerating the use of amphibious vehicles in emergency response operations, particularly in flood-prone areas. In 2022, over 140 disaster events occurred across Asia-Pacific, affecting millions of people, particularly in flood-prone countries like India, Pakistan, and Bangladesh. The unique ability of amphibious vehicles to navigate submerged or damaged infrastructure makes them indispensable in delivering aid and evacuating people in such situations.

Order a free sample PDF of the Amphibious Vehicle Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America’s Market Share: North America accounted for 45.8% of the global revenue share in 2024, driven by military modernization efforts focused on amphibious combat capabilities and increasing demand for multi-mission vehicles. A notable development is BAE Systems’ contract with the U.S. Marine Corps in January 2024 for the production of 33 additional Amphibious Combat Vehicles.

- Propulsion Systems: Track-based propulsion systems held the largest market share in 2024, accounting for 51.3%. These systems are favored for their superior traction and mobility in difficult terrains like mud, swamp, and floodplains, making them ideal for military operations and construction projects in challenging environments.

- Armored Amphibious Vehicles: The armored amphibious vehicle segment was the largest by revenue in 2024. This growth is driven by the need for versatile, advanced combat vehicles capable of operating in diverse terrains. International collaborations, like the partnership between ST Engineering and Kazakhstan Paramount Engineering, highlight the expansion of this segment.

- Military Combat & Troop Transport: This segment dominated by revenue in 2024 due to increasing military modernization, rising geopolitical tensions, and advancements in vehicle survivability and unmanned system integration. Strategic investments are being made to enhance amphibious assault and littoral combat capabilities.

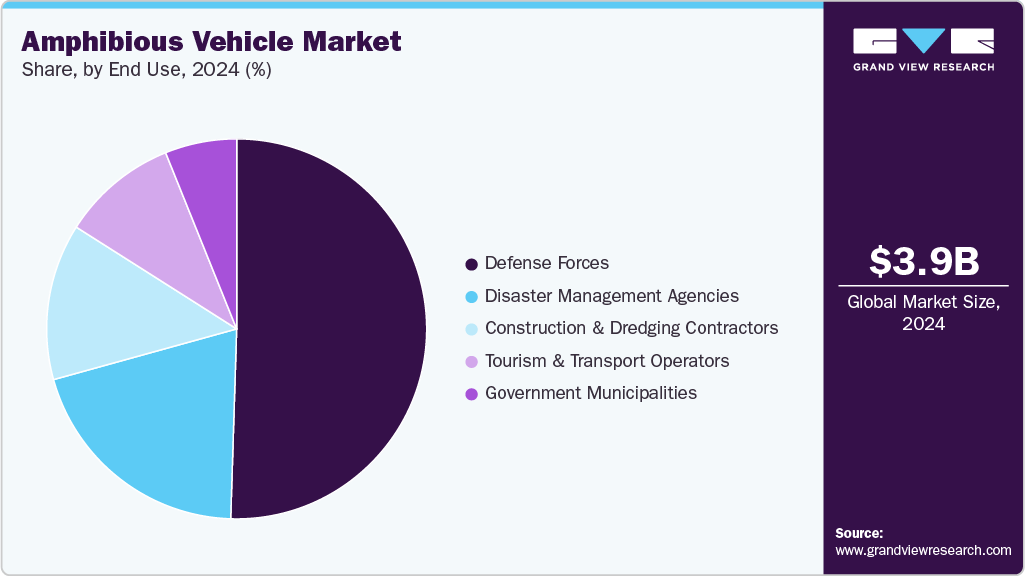

- Defense Forces: The defense sector held the largest revenue share in 2024, driven by the procurement of advanced amphibious vehicles for enhanced mobility across multiple terrains. Ongoing military modernization initiatives and heightened global tensions are driving this demand.

Market Size & Forecast

- 2024 Market Size: USD 3.96 Billion

- 2030 Projected Market Size: USD 6.47 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Prominent players in the amphibious vehicle market include:

- BAE Systems plc: A global defense, security, and aerospace company based in London, UK. It designs and manufactures advanced amphibious vehicles, combat systems, and military platforms, including armored vehicles and naval ships. The company leverages cutting-edge technologies such as autonomous systems and electronic warfare.

- General Dynamics Corporation: A Virginia-based aerospace and defense company specializing in amphibious combat vehicles, armored systems, and mission-critical technologies. Their portfolio includes the Amphibious Combat Vehicle (ACV), ground combat vehicles, and marine systems.

Key Players

- BAE Systems plc

- General Dynamics Corporation

- Rheinmetall AG

- Hanwha Aerospace

- Hitachi Construction Machinery Co., Ltd.

- EIK Engineering Sdn. Bhd.

- Wetland Equipment Company

- Wilco Manufacturing L.L.C.

- Hydratrek, Inc.

- Marsh Buggies Incorporated

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The amphibious vehicle market is on a strong growth trajectory, fueled by defense modernization, increased demand for emergency response solutions, and infrastructure development in flood-prone regions. While the high production and operational costs remain a challenge, the increasing demand for versatile amphibious platforms across various sectors—including defense, disaster management, and construction—presents substantial opportunities for market players. With North America leading the market, the expansion of military capabilities and the integration of advanced technologies in amphibious vehicles are expected to further propel market growth in the coming years.

No comments:

Post a Comment