The U.S. viral vector and plasmid DNA manufacturing market was valued at USD 2.2 billion in 2023 and is forecasted to reach USD 8.0 billion by 2030, growing at a CAGR of 20.0% from 2024 to 2030. This growth is driven by the increasing involvement of companies in gene and cell therapy research and development, supported by a significant number of contract development organizations (CDOs) operating in the U.S. Additionally, domestic firms are expanding their manufacturing capabilities within the country.

In 2023, the U.S. held a 42.0% share of the global viral vector and plasmid DNA manufacturing market. Growth is further fueled by rising government investments and the increasing prevalence of targeted diseases. For instance, according to the Spinal Muscular Atrophy Foundation in 2020, approximately 10,000 to 25,000 adults and children in the U.S. were affected by spinal muscular atrophy, highlighting the demand for gene therapy in treating rare diseases.

The market for cell and gene therapy manufacturing is highly competitive due to numerous contract manufacturers and research organizations. New entrants and facility expansions by existing players have intensified competition within the U.S. Thermo Fisher Scientific, Inc. and Lonza are prominent market participants, employing various strategies to strengthen their positions. For example, in July 2021, Thermo Fisher Scientific announced the opening of a new current Good Manufacturing Practice (cGMP) viral vector and plasmid DNA production facility in Carlsbad, California, aimed at meeting growing demand for mRNA-based vaccines and plasmid DNA therapies.

Order a free sample PDF of the U.S. Viral Vector And Plasmid DNA Manufacturing Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By vector type, the adeno-associated virus (AAV) segment led the market in 2023, capturing the largest revenue share of 19.8%. The segment’s growth is supported by effective vector recovery and clarification processes, which commonly use centrifugation or Tangential-Flow Filtration (TFF) followed by alkaline or heat lysis methods to extract plasmid DNA (pDNA) from biomass.

- By workflow, downstream processing dominated the market with a 53.3% revenue share in 2023. This phase involves multiple purification steps categorized into capture, intermediate purification, and polishing. Techniques such as chromatography and ultrafiltration are widely used during intermediate purification and polishing.

- By application, vaccinology accounted for the largest revenue share of 22.0% in 2023. The strong demand for vaccines addressing various health conditions and cancers is expected to continue propelling market growth. The cell therapy segment is projected to grow at the fastest CAGR due to the increasing adoption of next-generation transfer vectors.

- By end use, research institutes dominated the market in 2023, holding 58.0% of revenue share. This dominance reflects the high demand for vectors to support research activities and the growing participation of scientific communities in gene and cell therapy studies.

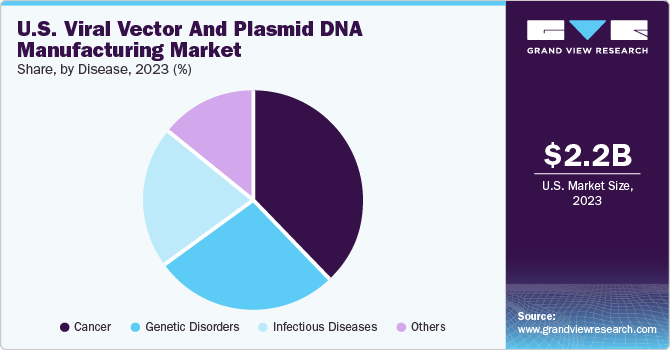

- By disease, cancer led the market with a 38.0% revenue share in 2023. Market growth in this segment is attributed to the expanding use of vectors in developing cancer therapies, a growing number of research programs, and recent approvals of gene therapy products.

Market Size & Forecast

- 2023 Market Size: USD 2.2 Billion

- 2030 Projected Market Size: USD 8.0 Billion

- CAGR (2024-2030): 20.0%

Key Companies & Market Share Insights

Leading players in the U.S. viral vector and plasmid DNA manufacturing market include Thermo Fisher Scientific, Inc., Catalent Inc., and Waisman Biomanufacturing.

- Thermo Fisher Scientific, Inc. produces laboratory reagents, equipment, analytical instruments, consumables, and diagnostic products. The company operates under multiple brands such as Thermo Scientific, Applied Biosystems, Fisher Scientific, Invitrogen, and Unity Lab Services. It is structured into four main segments: analytical instruments, life sciences solutions, specialty diagnostics, and laboratory products & services.

- Catalent, Inc. offers innovative manufacturing services to pharmaceutical companies globally. Operating across five continents with 30 facilities worldwide, Catalent’s services include manufacturing and packaging a variety of injectable, oral, and respiratory dosage forms. The company delivers over 70 billion doses for more than 7,000 products.

Key Players

- Thermo Fisher Scientific, Inc.

- Catalent Inc.

- Waisman Biomanufacturing

- Genezen

- Revvity (SIRION Biotech)

- Virovek Incorporation

- Charles River Laboratories (Cobra Biologics)

- RegenxBio, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. viral vector and plasmid DNA manufacturing market is set for rapid growth, driven by robust research activity in gene and cell therapies, expanding contract development organizations, and increased government funding. The dominance of key players such as Thermo Fisher Scientific and Catalent, along with advancements in manufacturing technologies and the rising prevalence of diseases like cancer and spinal muscular atrophy, underpin the market’s positive outlook. The increasing demand for advanced therapies and vaccines will continue to fuel market expansion through 2030, positioning the U.S. as a critical hub in global viral vector and plasmid DNA manufacturing.

No comments:

Post a Comment