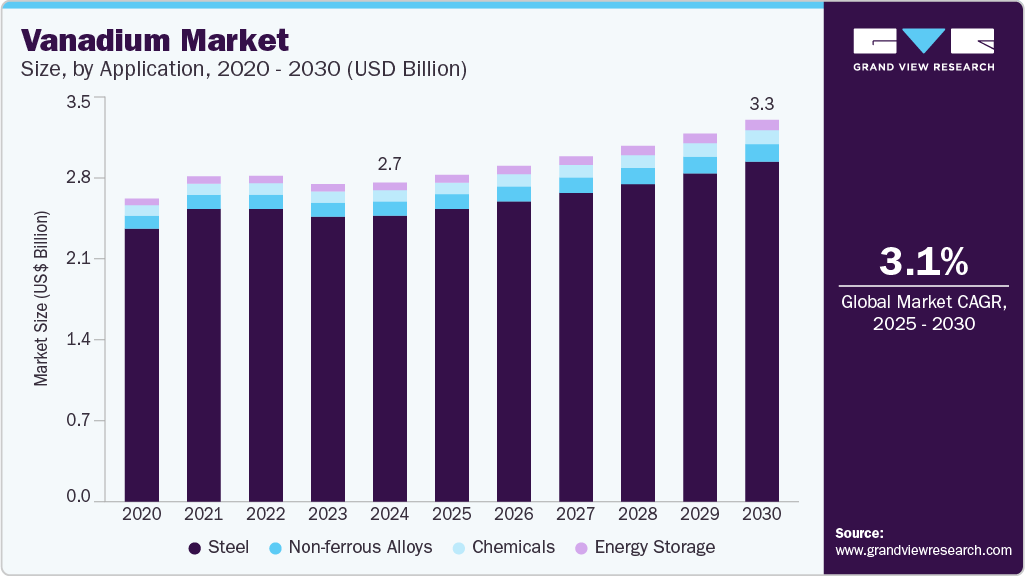

The global vanadium market was valued at approximately USD 2.7 billion in 2024 and is projected to reach USD 3.28 billion by 2030, growing at a compound annual growth rate (CAGR) of 3.1% from 2025 to 2030. The increasing production of crude steel, driven by rising demand from the construction, automotive, machinery, and transportation sectors, is expected to boost the demand for vanadium in the coming years.

Vanadium is primarily used as an alloying element in steel manufacturing, enhancing the strength, durability, and wear resistance of steel. The growing need for high-strength steel in construction, automotive, and aerospace industries continues to drive vanadium consumption. Additionally, rising global investments in infrastructure and industrial manufacturing are contributing to the demand for vanadium. For example, the International Energy Agency (IEA) reported that global investment in infrastructure rose from USD 3.2 trillion in 2019 to USD 3.8 trillion in 2023, which is anticipated to further increase the demand for high-strength steel and, consequently, the vanadium market.

The global vanadium market is experiencing steady growth due to its essential role in high-strength steel production, which accounts for approximately 90% of its consumption. Vanadium's ability to enhance the strength, durability, and corrosion resistance of steel makes it indispensable in key sectors such as construction, automotive, and heavy machinery. According to the World Steel Association, global crude steel output rose from 1,878.6 million tons in 2019 to 1,892.6 million tons in 2023, indicating a stable demand trajectory from steel-intensive industries.

Order a free sample PDF of the Vanadium Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- The Asia Pacific vanadium market is expected to grow at a CAGR of 3.3% during the forecast period. This growth is largely attributed to increasing investments in the vanadium market across the region. China dominates the Asia Pacific vanadium market due to its massive steel production capacity and vertically integrated supply chains. The country benefits from abundant vanadium-bearing resources and a well-established manufacturing ecosystem, enabling it to meet large-scale domestic demand in construction, automotive, and infrastructure sectors.

- By application, steel accounted for the largest market share of 89.7% in 2024. The vanadium market is set for steady growth, driven primarily by its critical role in steel manufacturing. As a key alloying element, vanadium enhances the strength, durability, and corrosion resistance of steel, making it vital for applications in infrastructure, construction, automotive, and industrial machinery. With global urbanization, industrialization, and government investments in resilient infrastructure and transportation networks increasing, the demand for high-performance steel continues to rise.

- The rapid growth of the energy storage sector, projected to expand at a CAGR of 5.2%, presents significant opportunities for the vanadium market. This growth is largely driven by the global transition toward renewable energy sources such as solar and wind, which require reliable, long-duration storage to balance intermittent supply. Vanadium redox flow batteries (VRFBs) have emerged as a preferred solution due to their long cycle life, deep discharge capabilities, and scalability for grid applications.

Market Size & Forecast

- 2024 Market Size: USD 2.7 Billion

- 2030 Projected Market Size: USD 3.28 Billion

- CAGR (2025-2030): 3.1%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Key players in the vanadium market include HBIS Group Co., Ltd., Bushveld Minerals, Largo Inc., Australian Vanadium Limited, and others. These organizations are strategically focused on expanding production capacity, securing long-term supply chains, and exploring emerging applications such as energy storage. To gain a competitive edge, leading players are actively pursuing initiatives such as mergers and acquisitions, joint ventures, and partnerships—especially in regions prioritizing renewable energy and critical minerals development. This collaborative approach aims to strengthen their market presence and respond to the rising global demand for vanadium across industrial and clean energy sectors.

- HBIS Group Co., Ltd. is one of the world's largest steelmakers and a leading vanadium producer, operating captive vanadium resources and integrating vanadium extraction into its steel production chain. This scale and supply chain control make it a dominant player in the market.

- Bushveld Minerals is a vertically integrated vanadium platform that owns primary vanadium assets, processing facilities, and downstream energy storage projects, including VRFBs.

Key Players

- AMG

- Aura Energy Ltd

- Australian Vanadium Limited

- Bushveld Minerals

- EVRAZ plc

- Glencore

- HBIS Group

- Largo, Inc.

- Pangang Group Vanadium and Titanium Resources Co., Ltd.

- Vanadium Resources Limited

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The vanadium market is poised for steady growth, primarily driven by rising crude steel production and the increasing demand for high-strength steel across various industries. With Asia Pacific leading the market and significant opportunities emerging in the energy storage sector, vanadium is expected to play a crucial role in supporting industrial applications and the transition to renewable energy. As investments in infrastructure and clean energy continue to rise, the market outlook for vanadium appears promising, with ample opportunities for innovation and expansion.

No comments:

Post a Comment