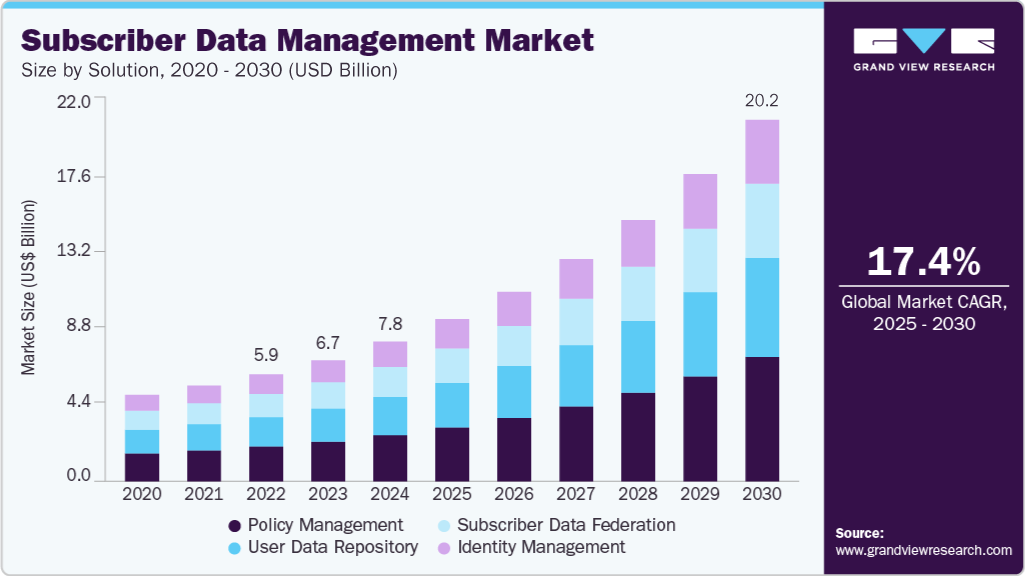

The global subscriber data management market is estimated to be valued at USD 7.8 billion in 2024 and is projected to reach USD 20.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 17.4% from 2025 to 2030. The market's growth is driven by several key factors, including the rising prevalence of infectious diseases among companion and livestock animals, increasing pet ownership, and heightened awareness of animal health.

Additionally, the shift toward cloud and hybrid cloud deployments is enabling telecom operators to adopt scalable and flexible subscriber data management (SDM) solutions. However, the high implementation costs of advanced SDM platforms present a significant challenge, particularly for small and mid-sized operators. The growing demand for fixed mobile convergence (FMC) and VoIP services also offers major growth opportunities for the market.

The increasing demand for 5G networks and the Internet of Things (IoT) is a significant driver of growth in the SDM market. The higher speeds and lower latency of 5G create new opportunities across various industries, from autonomous vehicles to smart cities. To manage the influx of connected devices and services, operators require robust SDM solutions to ensure efficient data handling, security, and seamless user experiences. For instance, in August 2022, Orange Egypt extended its partnership with Nokia to modernize its SDM infrastructure, preparing for 5G services and enhancing operational efficiency. This highlights the growing importance of SDM in supporting advanced network architectures and managing complex 5G and IoT ecosystems.

Order a free sample PDF of the Subscriber Data Management Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America dominated the subscriber data management market, accounting for 31.5% of the revenue share in 2024. The market's growth in this region is driven by the rapid expansion of 5G networks and the increasing demand for efficient data management solutions to handle growing subscriber data. The widespread adoption of cloud-native core networks by major telecom operators, including AT&T and Verizon, is further fueling the need for scalable SDM platforms for real-time data synchronization and policy control.

- The policy management segment led the market with a revenue share of 33.1% in 2024. This growth is attributed to the increasing adoption of 5G core networks and the need for dynamic, real-time control of data sessions and services. Operators are deploying advanced policy control functions (PCF) to support differentiated services, QoS enforcement, and slicing strategies in 5G environments.

- The mobile networks segment accounted for the largest revenue share in 2024, driven by the rapid expansion of 5G deployments, rising mobile data traffic, and the growing number of mobile subscribers. The adoption of cloud-native mobile cores and network slicing is prompting mobile operators to invest in advanced SDM platforms that support real-time subscriber data processing and dynamic policy control.

- The mobile application segment represented the largest revenue share in 2024, fueled by the rapid adoption of 5G networks, increased mobile data consumption, and a growing number of mobile-based applications such as streaming, gaming, and e-commerce. According to the GSM Association, the number of unique mobile subscribers is expected to grow from 5.8 billion in 2024 to 6.5 billion by 2030, highlighting the ongoing global expansion of mobile services.

- By deployment mode, the on-premises segment captured the largest market revenue share in 2024, driven by the demand for full control over data security and compliance. Traditional infrastructures, especially in legacy systems, still dominate many sectors where data privacy and regulatory requirements are paramount.

- In terms of organization size, the large enterprises segment accounted for the largest market revenue share in 2024, driven by the need for advanced data management systems, high-volume subscriber data processing, and regulatory compliance. Larger enterprises typically have bigger technology budgets and require tailored SDM solutions to meet their specific needs.

Market Size & Forecast

- 2024 Market Size: USD 7.8 Billion

- 2030 Projected Market Size: USD 20.2 Billion

- CAGR (2025-2030): 17.4%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Key players in the market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Nokia Corporation, Oracle Corporation, and Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson, established in 1876 and headquartered in Stockholm, Sweden, is a leading player in telecommunications and subscriber data management solutions. The company provides end-to-end network infrastructure, cloud-native software, and managed services to telecom operators. Ericsson’s SDM portfolio includes products for unified data management, policy control, and user data consolidation across 4G, 5G, and IoT networks, supporting mobile operators in over 180 countries.

- Huawei Technologies Co., Ltd., founded in 1987 and headquartered in Shenzhen, China, is a global provider of information and communications technology (ICT) infrastructure and smart devices. In the subscriber data management space, Huawei offers cloud-native SDM solutions designed for multi-access, high concurrency, and distributed deployment across 5G, IoT, and converged networks, with operations in more than 170 countries.

Key Players

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Oracle Corporation

- Cisco Systems, Inc.

- Amdocs Limited

- Hewlett Packard Enterprise Company

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- Mavenir Systems, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The subscriber data management market is poised for significant growth, driven by the increasing demand for efficient data management solutions amid the rapid expansion of 5G networks and IoT. As telecom operators seek to enhance their capabilities, the need for scalable and flexible SDM solutions will become more crucial. With North America leading the market and large enterprises driving demand, the SDM landscape will continue to evolve, presenting opportunities for innovation and collaboration among key players in the industry.

No comments:

Post a Comment